New york city has several tax abatement programs in place. Icap is filed when developing a new building.

An Efficient Use Of Public Dollars A Closer Look At The Market Effects Of The 421-a Tax Break For Condos

New york city department of.

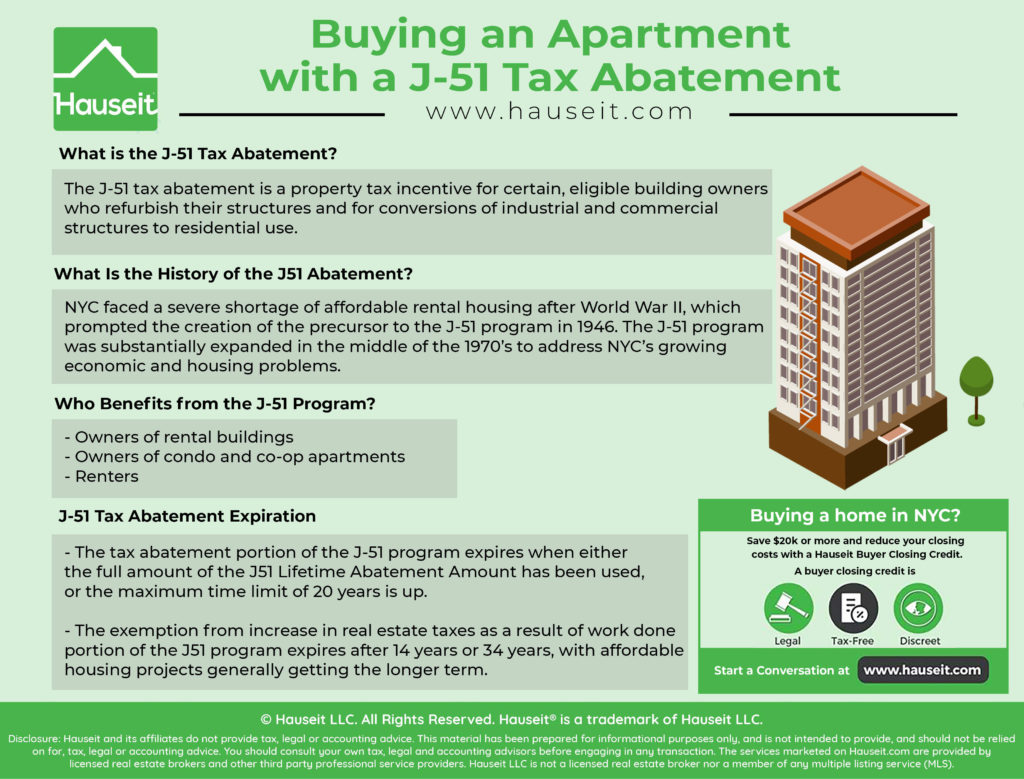

J-51 tax abatement phase out. The benefit varies depending on the building's location and the type of improvements. Eligible projects for this program include: A lot of landlords complained they didn’t have the money to add these to their building.

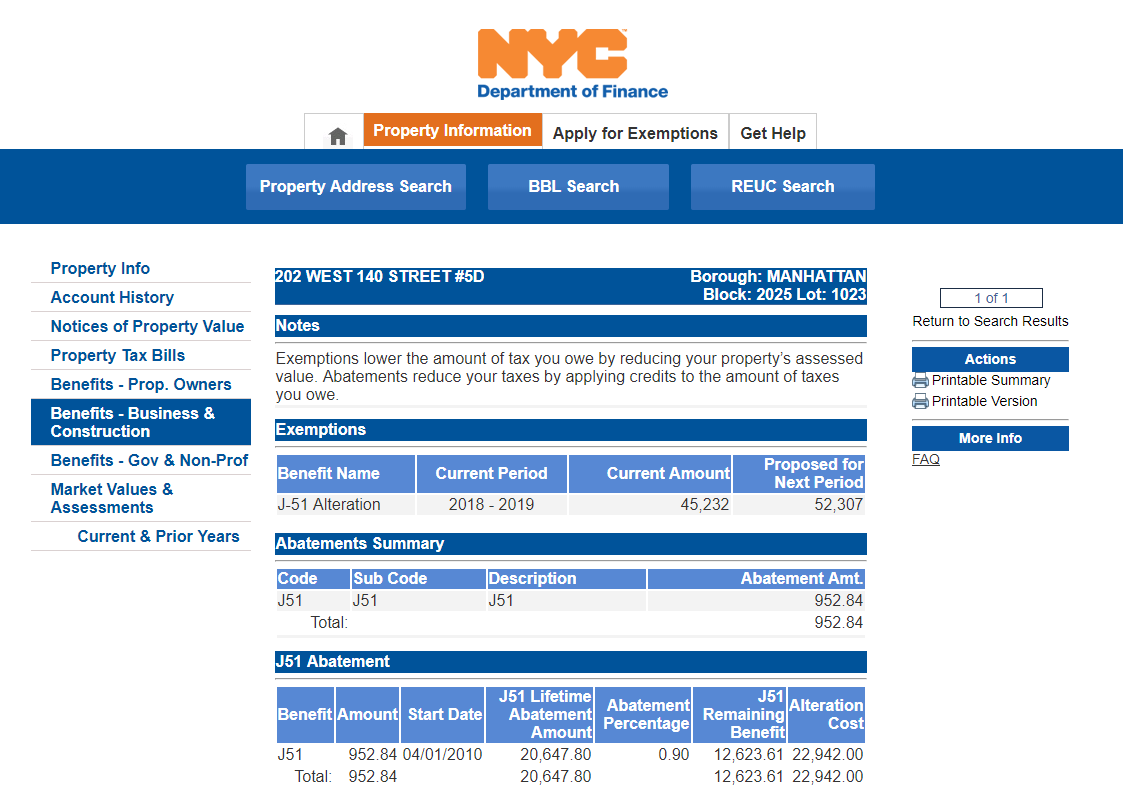

Nyc is a trademark and service mark of the city of new york. Tax abatementthe j51 abatement benefits serve to reduce the property’s tax liability otherwise payable. After that, the department of finance will adjust the taxes during the abatement period.

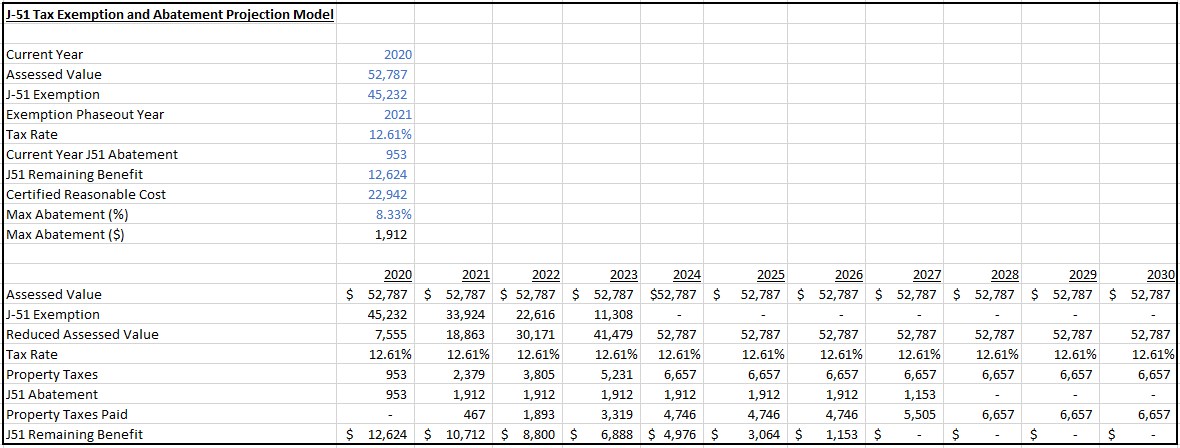

Then, the length of the abatement varies, but it is usually 10 years. The nyc department of housing preservation and development (hpd) determines eligibility for this program. The j51 exemption portion effectively freezes a building’s increase in assessed value, resulting from the alteration or improvement of a building or structure, except insofar as the gross cubic content of the building is increased thereby and for the prorated commercial area of the building.

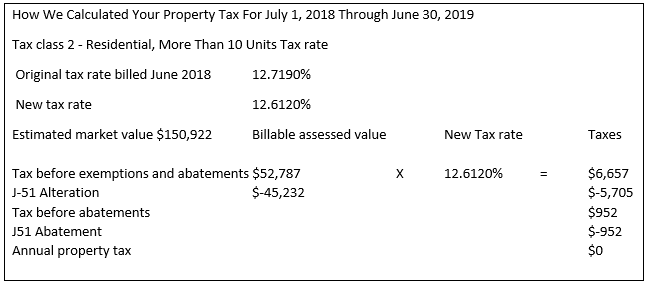

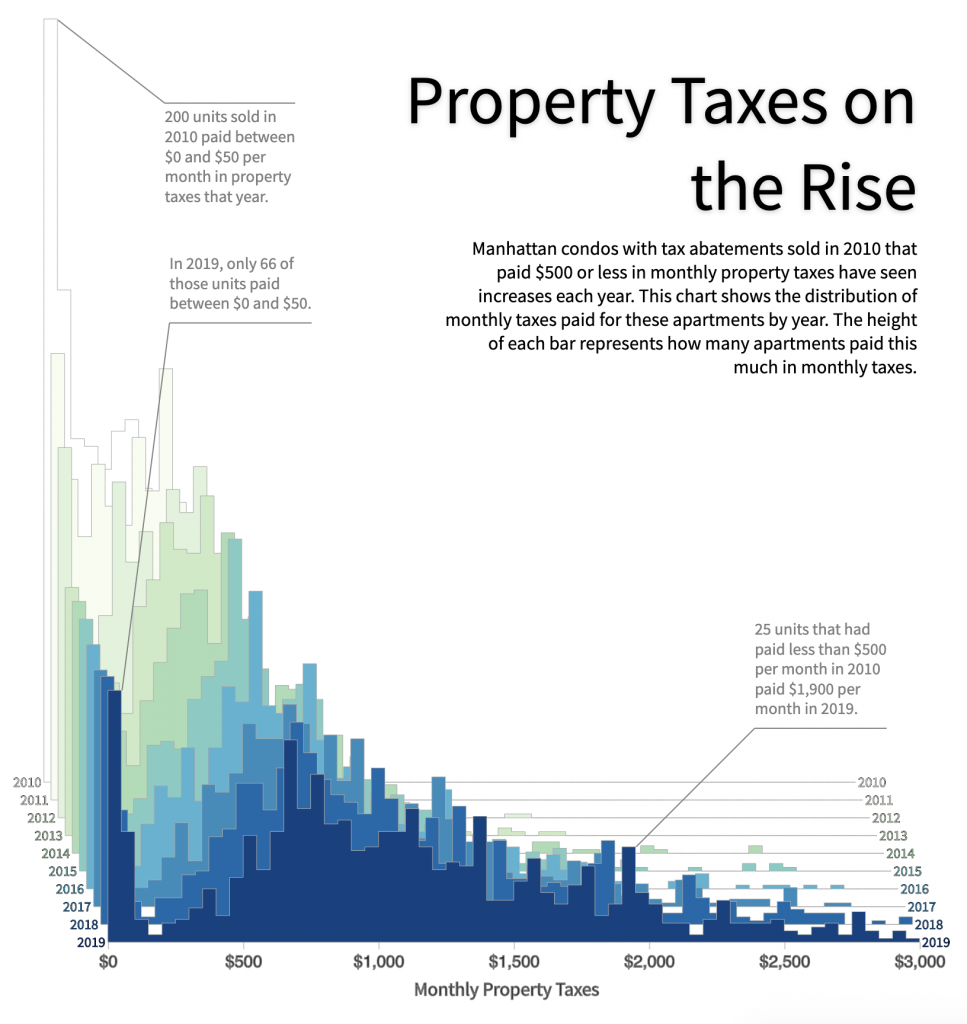

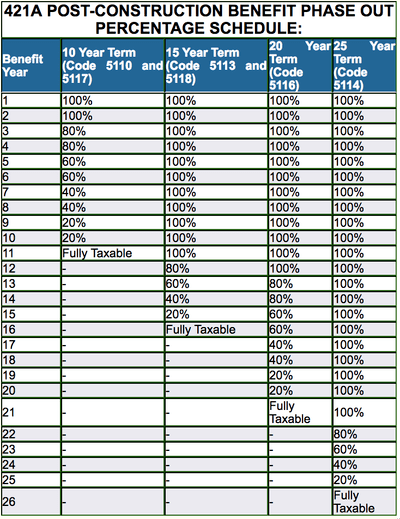

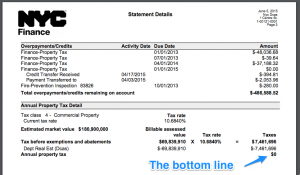

Is tax bills rising faster than they would from higher home values. Abatements phase out in stages at the end, so with only a year left, this condo is close to using up its exemption. Nyc department of housing preservation and development (nyc hpd) status:

In most cases, the increase in assessed value resulting from rehabilitation work is fully exempt for 10 years, and phases out over four years, for a total exemption period of 14 The j51 abatement benefits serve to reduce the property’s tax liability otherwise payable. The exemption will last for a period of fourteen years,.

The abatements were originally designed to be phased out in 10 to 35 years. This may be technically true, but it is a bit deceiving. And if your building was.

For renovation of a residential building, the abatement is calculated and determined based on 90% of the lesser of:. © 2021 city of new york. Keep in mind that this model generously assumes that nyc won’t ever increase the headline assessed value of the.

To be eligible for this benefit, you must have renovated your structure or plan to convert an industrial or commercial structure into a residential building.

Buying An Apartment With A J-51 Tax Abatement Hauseit

Ibonycnyus

J-51 Tax Program Decline Hpd To Revise

Expiring Nyc Tax Abatements Are Hurting The Condo Market Streeteasy

Buying An Apartment With A J-51 Tax Abatement Hauseit

J51 Exemption Abatement

Buying An Apartment With A J-51 Tax Abatement Hauseit

Nyc 421a Tax Abatements - What Are They And How To Verify - Yoreevo Yoreevo

421a Tax Abatement Archives Nestapple

Buying An Apartment With A J-51 Tax Abatement Hauseit

When The J-51 Bubble Bursts - The New York Times

Understanding The J-51 Tax Abatement Propertyclub

Buying An Apartment With A J-51 Tax Abatement Hauseit

Buying An Apartment With A J-51 Tax Abatement Hauseit

Nyc Tax Abatements Guide - 421a J-51 And More Prevu

Buying An Apartment With A J-51 Tax Abatement Hauseit

Buying An Apartment With A J-51 Tax Abatement Hauseit

The Benefits Of J51 Exemption And Abatement Today Prime Real Estate Partners

Buying An Apartment With A J-51 Tax Abatement Hauseit