State unemployment taxes are payable every quarter. There is a definite benefit to paying on time.

Withholding Tax Virginia Tax

Once that limit has been met, employer and employee shares of social security and medicare taxes must be remitted.

Nanny tax calculator virginia. This tool will help you and your nanny understand the amount of money she will actually receive each payday. Additions to wages, if any. Use salary vs overtime to calculate employee overtime pay.

The irs estimates that it would take you 60 hours to comply with the federal nanny tax regulations. Use the “pay adjustment” field to make up for any additional wages you paid (or withheld) for things such as a holiday bonus or an unpaid day off. When does your nanny need to be present for work?

The most common practice is to agree on a standard weekly salary based on a standard number of hours worked per week. What is the nanny tax? Nanny taxes are the employment taxes for those who hire household workers like nannies, housekeepers, and senior caregivers and pay them more than the nanny tax threshold (for 2021, this threshold is $2,300).

State nanny taxes (unemployment and income taxes) are generally paid quarterly, although some states have monthly or annual filing requirements. Instead, it’s a diy service that lets you calculate nanny payroll taxes and reach out to customer service for tax resources if you run into trouble. Using the nanny pay calculator.

If neither of these two columns applies, then you do not need to pay any federal unemployment taxes. Enter your caregiver's payment info. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer, whether paying a nanny, a senior care worker, or other household employees.*.

The tax is 6.0% of cash wages. If you have previous employees, you may be subject to a different rate. By doing so, you earn a reduction of your federal unemployment tax (futa) rate from 6.2% down to 0.6*% (on wages up to $7,000), potentially saving you up to $378.

You can also print a pay stub once the pay has been calculated. In virginia, there is a new employer state unemployment insurance tax of 2.5% on the first $8,000 of wages for each employee. Nanny tax hourly calculator enter your employee’s information and click on the calculate button at the bottom of the nanny tax calculator.

Independent contractor status is determined before proceeding with payroll and tax plans for your new hire. Calculates federal, fica, medicare and withholding taxes for all 50 states. You must also state an hourly wage to meet federal guidelines.

You may have the option of reporting and paying the virginia income tax withheld from your employees on an annual basis. That does sound, well, taxing. It is intended to provide general payroll estimates only.

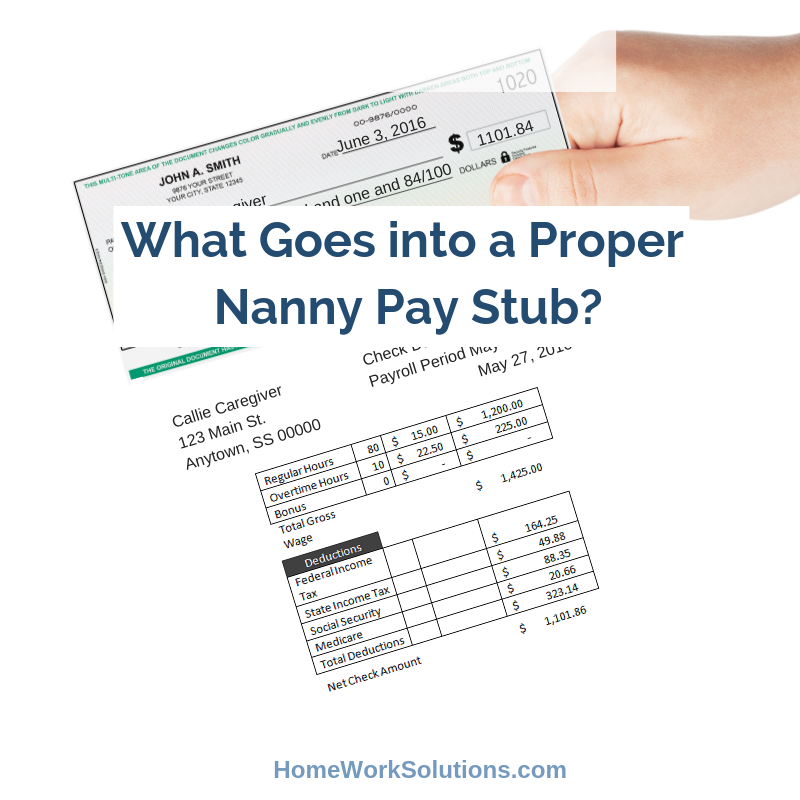

It is best to also include a sample pay stub. The nanny tax calculator for 2015 and 2016 taxes you will need to enter your nanny’s gross weekly pay and the number of weeks you paid your nanny. Supports hourly & salary income and multiple pay frequencies.

Check out our new page tax change to find out how. You also may owe state unemployment tax. The nanny tax calculator will show you how to:

Nanny tax calculator use gross/net to estimate your federal and state tax obligations for a household employee. While you are not required to withhold income taxes from your nanny’s wages, it is recommended that you do so to avoid your nanny having a large tax bill at the. Calculate your nanny paycheck deductions before you issue any payroll.

Wages over $7,000 a year per employee are not taxed. This calculator is a courtesy of care.com homepay, provided by breedlove. The payroll calculator is pretty handy, and the service costs only $29 for a full year.

This free, easy to use payroll calculator will calculate your take home pay. It can be difficult to determine who is a household employee, so we recommend learning more about how employee vs. However, you may still need to pay state unemployment taxes.

Let us help you determine your nanny tax and payroll needs. This will clearly demonstrate the deductions taken out of your nanny’s pay. Simple nanny payroll isn’t too fancy, but it’s definitely a step above a spreadsheet.

Ensure that as an employer, you are using updated federal income tax withholding rates per the irs. See the nanny hourly wage calculator below. Or if you need more help talking it through, get a free phone consultation with one of.

Nanny Tax Payroll Calculator Gtm Payroll Services

.png?width=800&name=2017%20W-2%20FORM%20(2).png)

W-2 Reporting Required For Nanny Tax-free Healthcare Benefits

Nanny Tax Payroll Calculator Gtm Payroll Services

Free Virginia Payroll Calculator 2021 Va Tax Rates Onpay

The Right Time To Put A Nanny Or Caregiver On The Books Hws

![]()

Virginia Nanny Tax Rules Poppins Payroll

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Virginia Nanny Tax Rules Poppins Payroll

Nanny Taxes Qa Who Owes Who Pays Hr Block Newsroom

Tax Calculator For Families Of Boston Nanny Centre Gtm Payroll Services Inc

5 Answers You Need When Using A Nanny Tax Calculator

How To Pay Your Nannys Taxes Yourself - Diy For Paying Household Employees

Employer Payroll Taxes For Domestic Household Workers

Virginia Tax And Labor Law Guide - Carecom Homepay

What Goes Into A Proper Nanny Pay Stub

Nanny Tax Calculators Nanny Payroll Calculators - The Nanny Tax Company

Tax Calculator For Families Of Nannies On The Go Gtm Payroll Services Inc

Nanny Tax Calculator Nanny Lane

Nanny Tax And Payroll Calculator - Carecom Homepay