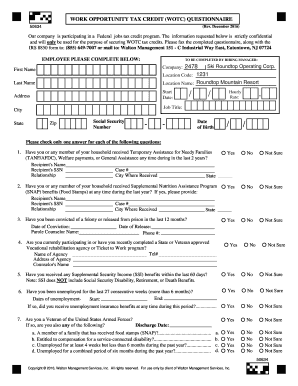

1) the employer or employer representative, the swa, a participating agency, or 2) the applicant directly (if a minor, the parent or guardian must signtheform) andsigned(box. March 2016 department of the treasury internal revenue service w2 form 2020 attention:

Dmaorg

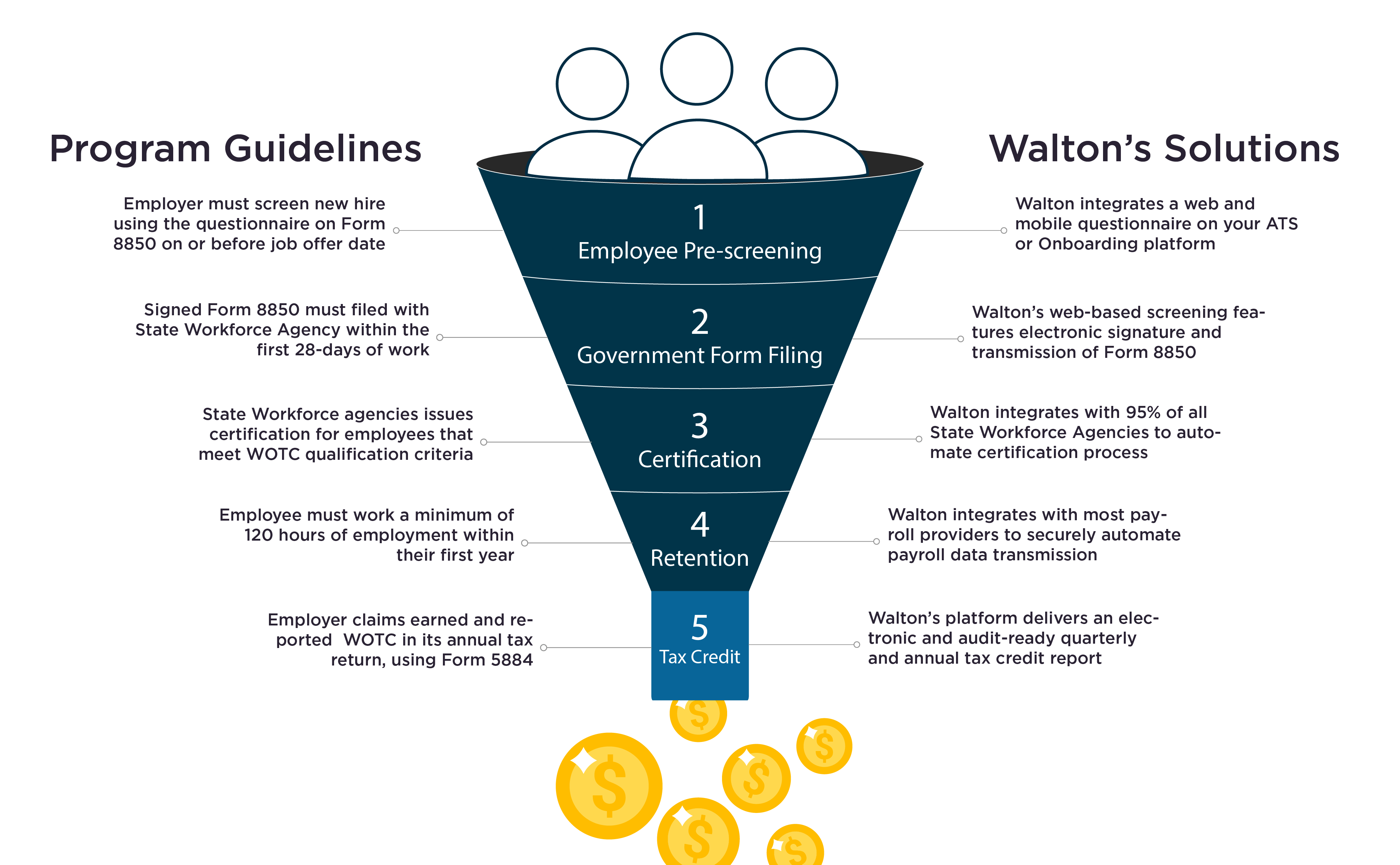

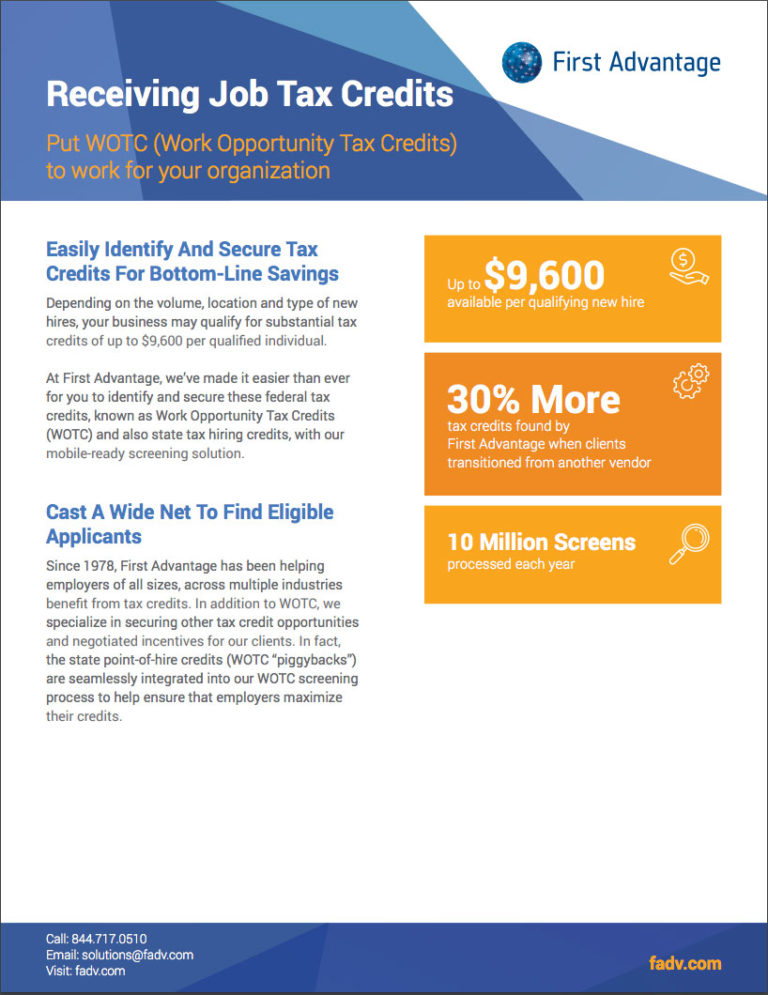

Get the most out of the work opportunity tax credit.

Work opportunity tax credit questionnaire form. Work opportunity tax credit questionnaire (wotc) we are happy to provide the following questionnaire to help determine how beneficial this program could be for your business before you commit the small amount of time and manpower necessary to participate fully. Internal revenue code section 51 (d) (13) permits a prospective employer to request the applicant to complete wotc form 8850 and give it to the prospective employer. In the case of the above question, the sender did not provide their email address, so we were unable to reply directly to them.

The form may be completed, on behalf of the applicant, by: By screening, hiring and retaining wotc qualified employees your business may receive a federal tax credit ranging from $1,500 to $9,600 per qualified individual, based on. However, some companies go on mass hiring sprees, targeting certain populations under these survey to take advantage of the tax credits.

Tap our proprietary technology to help simplify the process, identify more wotc eligible employees, and capture more tax credits for your company. The employee groups are those that have had significant barriers to employment. At cms, as work opportunity tax credit (wotc) experts and service providers since 1997, we receive a lot of questions via our website’s chat box, this one from a new hire:

These surveys are for hr purposes and also to determine if the company is eligible for a tax credit/deduction. Welcome to the georgia wotc online system. Since its enactment by congress in 1997, the work opportunity tax credit (wotc) program has been integral to the creation of jobs by giving employers a tax credit when they hire qualified individuals who consistently face significant barriers to employment.

Help state workforce agencies (swas) determine eligibility for the work opportunity tax credit (wotc) program. Work opportunity tax credit questionnaire employers receive substantial tax credits for hiring certain applicants under the work opportunity tax credit, or wotc, a program created by the u.s. This federal tax credit incentive program enables the new.

Eta 9061, individual characteristics form, irs 8850, state workforce agency, work opportunity tax credit, wotc, wotc deadlines, wotc forms about duane jess duane can’t help himself when it comes to reporting the news about wotc and other tax credits. Below you will find the steps to complete the wotc both ways. If so, you will need to complete the questionnaire when you apply to a position or after you've been hired (depending on the employer's workflow).

And administered by the internal revenue service. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a wotc targeted group. You may file forms w2 and w3 electronically on the ssas employer w2 filing instructions and information web page, which is also accessible at

Is participating in the wotc program offered by the government. Completion of this form is voluntary and may assist members of targeted groups in. Wotc (work opportunity tax credit) questionnaire k&s staffing solutions inc.

Employers use form 8850 to make a written request to their swa to certify someone for the work opportunity credit. Why is my ss# and date of birth required on wotc form? Based upon your responses, we will perform a free analysis of your wotc potential.

The wotc program is designed to promote hiring of individuals within target groups, who may face challenges securing employment due to limited skills or work experience. Georgia work opportunity tax credit. The work opportunity tax credit (wotc) program is a federal tax credit available to employers if they hire individuals from specific targeted groups.

Some employers integrate the work opportunity tax credit questionnaire in talentreef. The answers are not supposed to give preference to applicants. Work opportunity tax credit questionnaire page one of form 8850 is the wotc questionnaire.

It asks the applicant about any military service, participation in government assistance programs, recent unemployment and other targeted questions. The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a federal tax credit to employers who hire these individuals. The work opportunity tax credit (wotc) is a federal tax credit available to employers who invest in american job seekers who have consistently faced barriers to employment.

At cms, as work opportunity tax credit (wotc) experts and service providers since 1997, we receive a lot of questions via our website. The information will be used by the employer to complete the employer’s federal tax return. This tax credit program has.

Work opportunity tax credit management product sheet.

Wotc - Advapay Systems Payroll Services

Ncslorg

Wotc Questions What Is The Benefit To The Employee - Cost Management Services Work Opportunity Tax Credits Experts

Tax Credit Questionnaire Form - Fill Online Printable Fillable Blank Pdffiller

Wotc - Advapay Systems Payroll Services

Tax Credit Questionnaire Form - Fill Online Printable Fillable Blank Pdffiller

Pdf An Exploratory Study Based On A Questionnaire Concerning Green And Sustainable Finance Corporate Social Responsibility And Performance Evidence From The Romanian Business Environment

Tax Credit Questionnaire Form - Fill Online Printable Fillable Blank Pdffiller

Oecd-ilibraryorg

Retrotax - Tax Credit Administration Jazzhr Marketplace

Wotc - Hiring Credits Work Opportunity Tax Credit Comprehensive Guide Emptechcom

Fillable Online Wotc Form - Rt Employee Forms Fax Email Print - Pdffiller

Work Opportunity Tax Credits Wotc - Walton

Fillable Online Wotc Questionnaire - The Greer Group Inc Fax Email Print - Pdffiller

What Are Wotc Target Groups Emptech Blog

Work Opportunity Tax Credit First Advantage

Wotc - Advapay Systems Payroll Services

Wotc Forms - Cost Management Services Work Opportunity Tax Credits Experts

Wotc Forms - Cost Management Services Work Opportunity Tax Credits Experts