Reply of petitioner franchise tax board of the state of. Franchise tax board of california v.

Franchise Tax Board Of California V Hyatt Hyatt

Supreme court cases titled franchise tax board of california v.

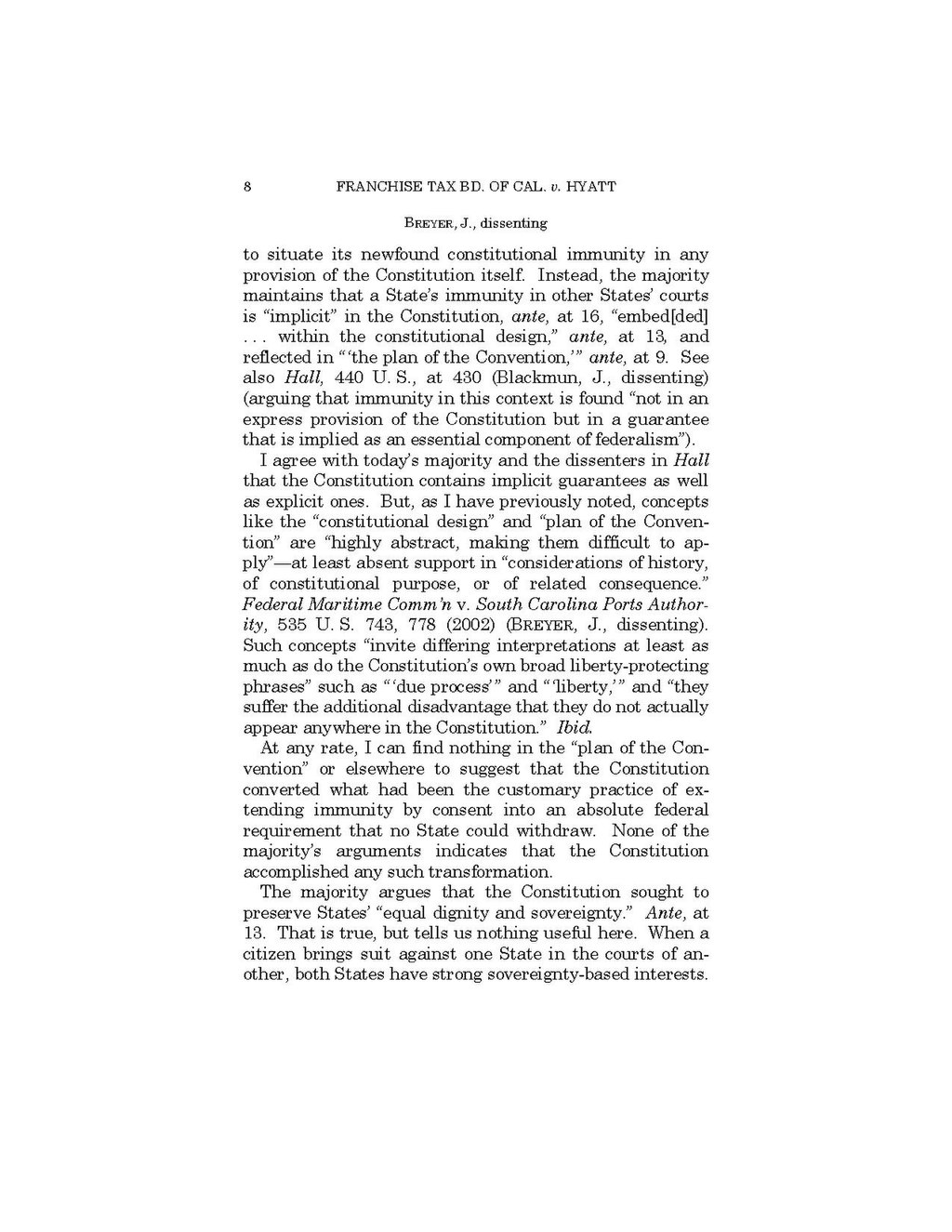

Franchise tax bd. of cal. v. hyatt. Hyatt, supreme court of united states. Despite this historical evidence that interstate sovereign immunity is preserved in the constitutional design, hyatt insists that such immunity exists only as a “matter of comity” and can be disregarded by the forum state. Supreme court of united states.

Subsequently, in 1996, the tax board issued an. Certiorari to the supreme court of nevada. 410, in which the court upheld a tort judgment rendered by california state courts arising out of an automobile accident in which an employee of the state of nevada injured a california resident while driving in california.

Franchise tax board of california v. Franchise tax board of california v. S., at ___ (slip op., at 5) (internal quotation marks omitted);

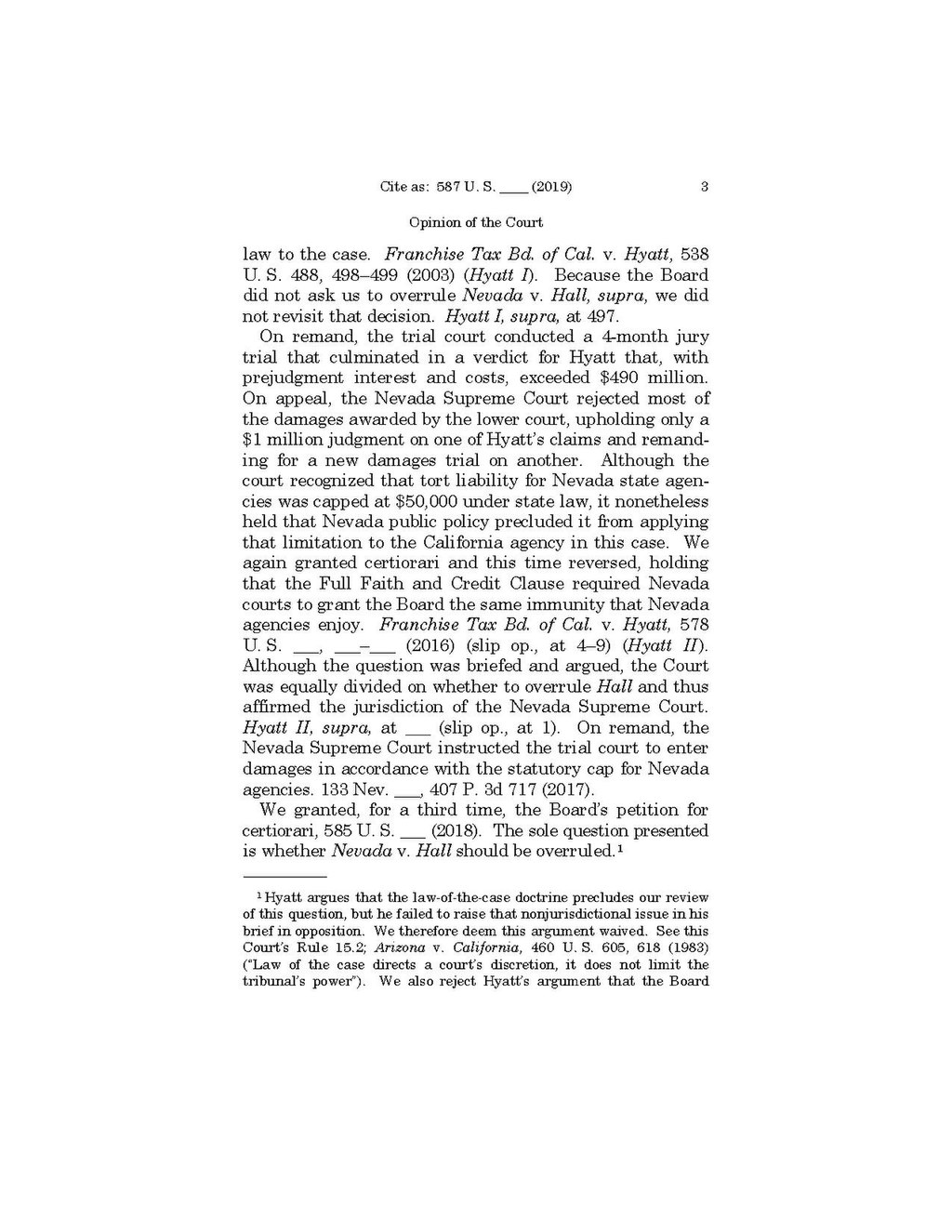

The case was remanded for trial, and hyatt was awarded almost $500. Thus, in 1993, the board launched an audit to determine whether hyatt underpaid his 1991 and 1992 state income taxes by misrepresenting his residency. In franchise tax board of california v.

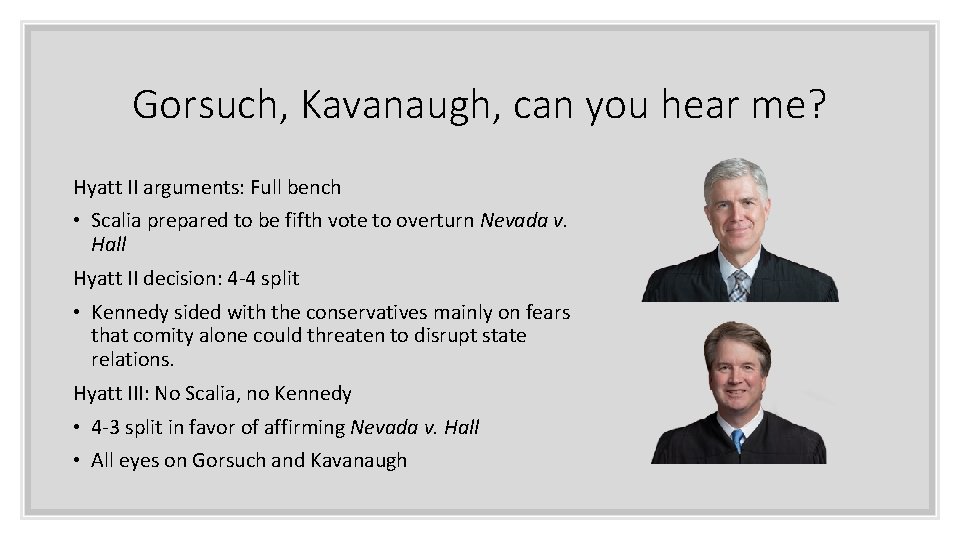

Franchise tax board of california v. There have been three u.s. Last term, in franchise tax board v.

Hyatt opinion of the court h. 488 (2003) franchise tax board of california v. Petitioner franchise tax board of california (board), the state agency responsible for assessing personal income tax, suspected that hyatt’s move was a sham.

On remand and following a trial, a jury awarded hyatt nearly $500 million in compensatory and punitive damages and fees, including attorney’s fees. Gilbert hyatt, an inventor, sued the franchise tax board of the state of california (ftb) in 1998 seeking damages for intentional torts and bad faith conduct allegedly committed by ftb auditors during tax audits of the inventor’s 1991 and 1992 state tax returns. ___ (2016) franchise tax board of california v.

Brief of respondent gilbert p. Brief amici curiae of professors of federal jurisdiction filed. Set for argument on wednesday, january 9, 2019:

With him on the brief were peter c. Marvel entertainment, llc, supreme court of united states. Record requested from the supreme court of nevada.

Franchise tax board of california v. Certiorari to the supreme court of nevada no. Bartow farr iiiargued the cause for respondents.

He reasons that, before the constitution was ratified, the states had the power of fully independent nations to deny immunity to fellow. Hall should be overruled and thus affirms the nevada courts' exercise of jurisdiction over california's state agency; And (2) the constitution does not permit nevada to.

[489] o'connor, j., delivered the opinion for a unanimous court. Although the question of whether or not to overturn nevada v. When gilbert hyatt sued the franchise tax board of california (ftb), a state agency, in a nevada court, california’s immunity existed at the discretion of the nevada courts.

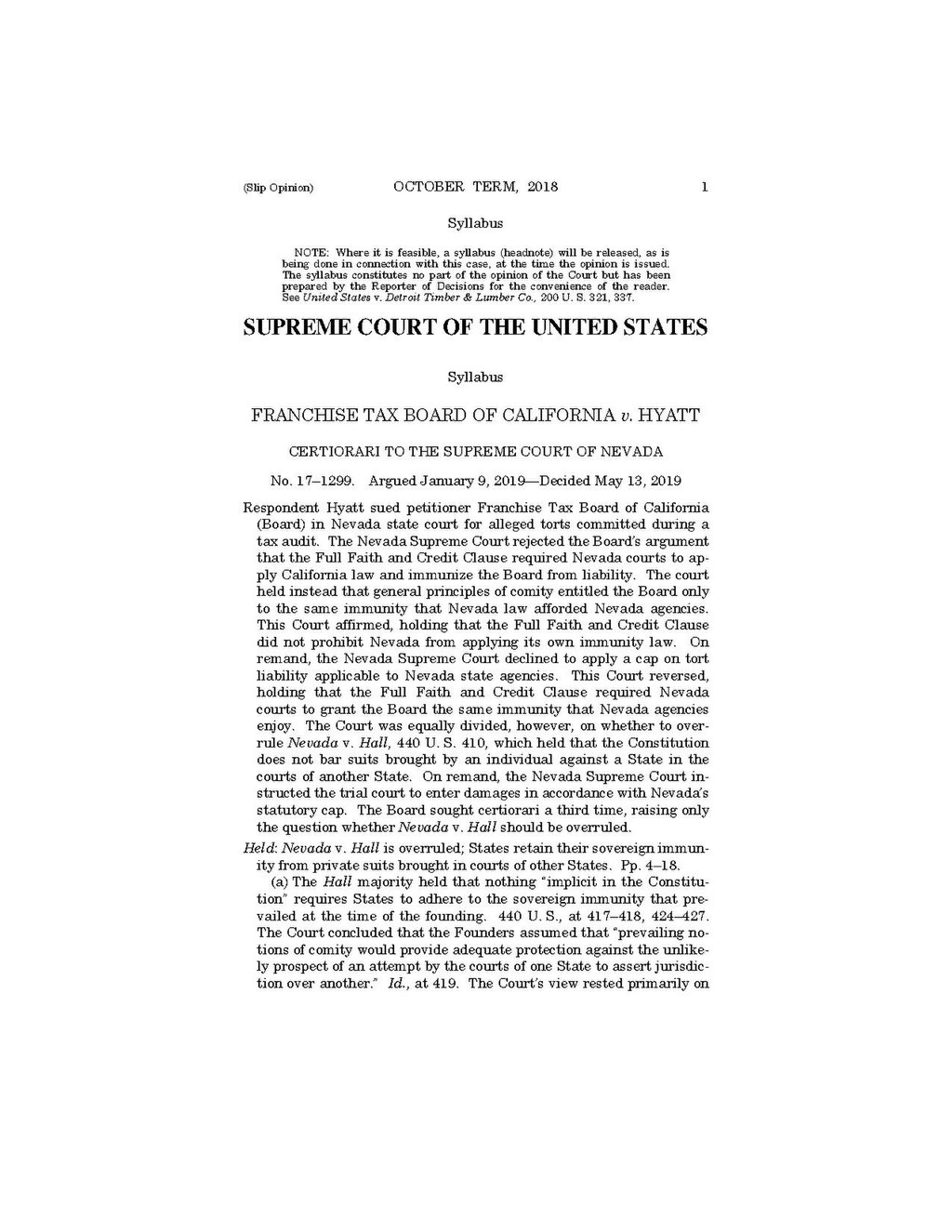

The nevada supreme court rejected the board’s argument that the full faith and credit clause required nevada courts to apply california law and immunize the board from liability. Respondent hyatt sued petitioner franchise tax board of california (board) in nevada state court for alleged torts committed during a tax audit. California appealed, arguing that the award violated the full faith and credit clause because nevada law would cap damages at $50,000 in a.

Leatherwood, deputy attorney general of california, argued the cause for petitioner. American federation of state, supreme court of united states. Petitioner franchise tax board is the california agency that collects california’s state income tax.

(1) the court is equally divided on the question whether nevada v. States must also afford citizens of each state “all privileges and immunities of citizens in the several states” and honor extradition requests upon “demand of the executive authority of the state” from which the fugitive fled. Franchise tax board of california v.

Respondent gilbert hyatt, a resident of nevada, filed suit in nevada state court against the board, alleging that it had committed numerous torts in the course of auditing his california tax returns. Respondent hyatt sued petitioner franchise tax board of california (board) in nevada state court for alleged torts committed during a tax audit. Kula.* justice o’connor delivered the opinion of the court.

488 (2003), the supreme court affirmed the nevada supreme court’s ruling that nevada courts, as a matter of comity, would immunize california to the same extent that nevada law would immunize its own agencies and officials.

Franchise Tax Board Of California V Hyatt 2019 - Wikipedia

Scotus Analysis Franchise Tax Board Of California V Hyatt Emory University School Of Law Atlanta Ga

Opinion Analysis Hyatt Fulfills Expectations In A Surprising Way - Scotusblog

Pagefranchise Tax Board Of California V Hyattpdf29 - Wikisource The Free Online Library

Argument Preview Immunity Precedent And Federalism In Franchise Tax Board Of California V Hyatt - Scotusblog

Mtr Of Hyatt V State Of California Franchise Tax Board

2

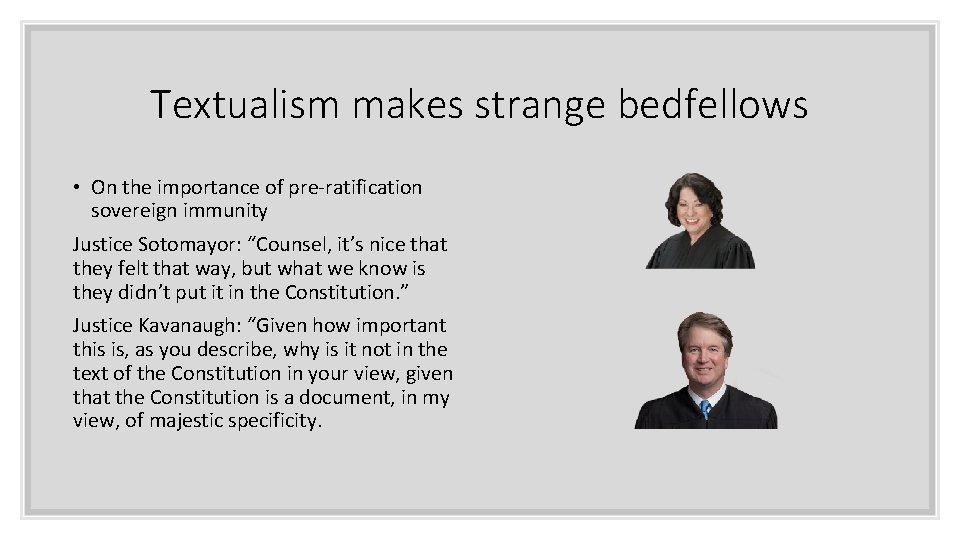

Argument Analysis Seeking Two-century-old Guidance - Scotusblog

Franchise Tax Board Of California V Hyatt Hyatt

Franchise Tax Board Of California V Hyatt 2019 - Wikipedia

Supreme Court Shows Its Ready To Overrule Precedent Dissent Sounds Alarm In California V Hyatt

Franchise Tax Board Of California V Hyatt Hyatt

Pagefranchise Tax Board Of California V Hyattpdf6 - Wikisource The Free Online Library

Pagefranchise Tax Board Of California V Hyattpdf1 - Wikisource The Free Online Library

Argument Analysis Seeking Two-century-old Guidance - Scotusblog

Franchise Tax Board Of California V Hyatt Hyatt

Franchise Tax Board Of California V Hyatt Scotusbrief - Youtube

Franchise Tax Board Of California V Hyatt

Pagefranchise Tax Board Of California V Hyattpdf3 - Wikisource The Free Online Library