Many electric car owners jump on the hov lane with out one,. This nonrefundable credit is calculated by a base payment of $2,500, plus an additional $417 per kilowatt hour that is.

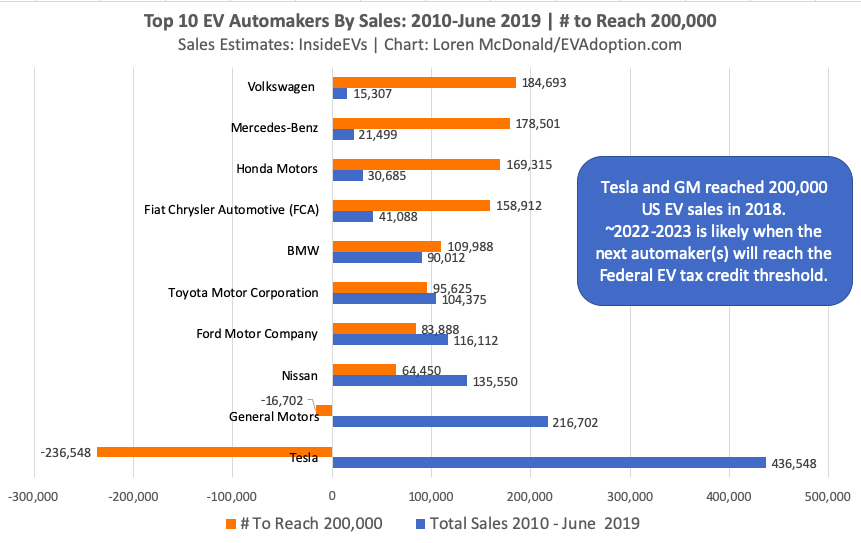

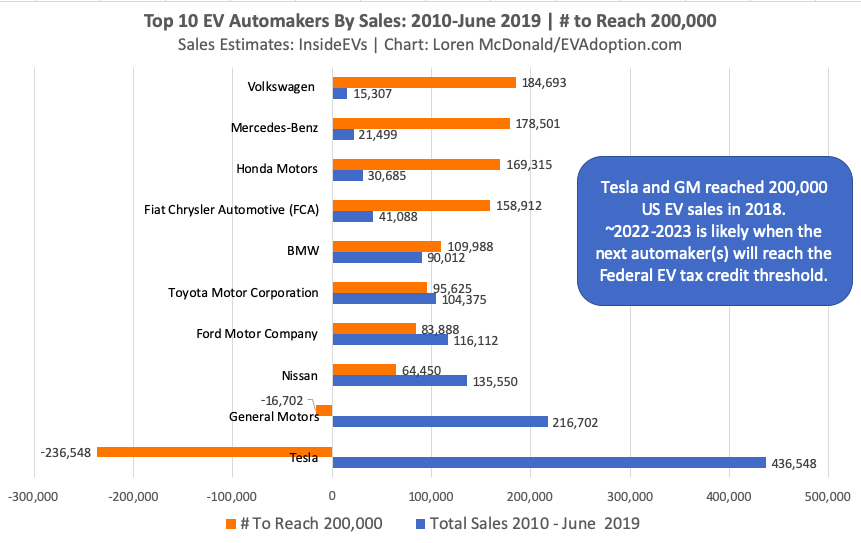

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Other tax credits are available if the battery size is 5kwh with a cap of $7500 credit if the battery exceeds 16kwh.

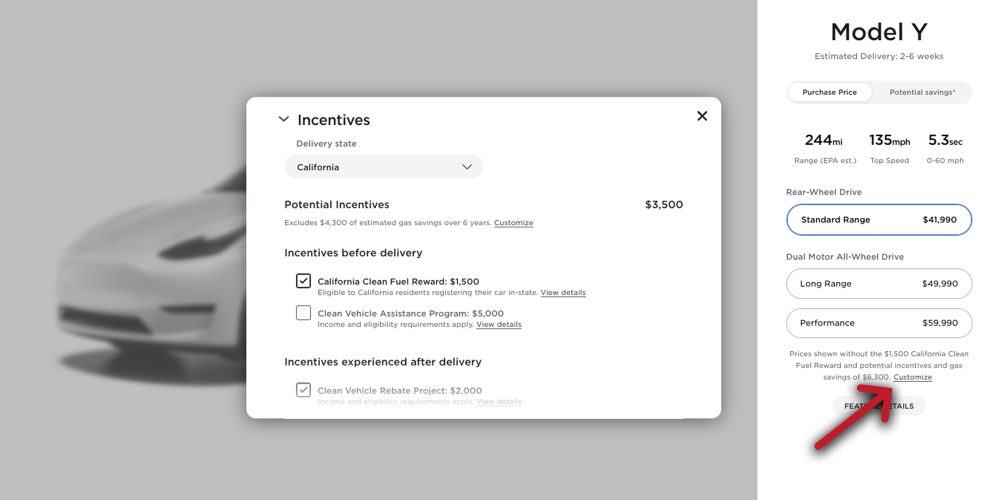

2021 electric car tax credit california. That being said, california is giving credits to ev owners for an electric car home charger. Add an additional $4,500 for evs assembled in. Hybrids and electric vehicles may not be a tax write off, but may instead be eligible for a credit on your return.

The clean energy act for america would benefit tesla by allowing most tesla vehicles to qualify for an $8,000 (house version) or $10,000 (senate version) refundable ev, electric vehicle tax credit while discouraging chinese evs. Beginning on january 1, 2021. Evs are affordable with or without incentives

The irs tax credit for 2021 taxes ranges from $2,500 to $7,500 per new electric vehicle (ev) purchased for use in the u.s. After six months, it’s reduced again, to 25 percent, for another six months, until finally the credit is phased out completely. Let's say you owed the federal government $10,000 in taxes when filing your 2021 taxes.

Whether you live in california or anywhere else in the united states, the federal government will give electric car owners a tax credit of up to $7,500. The exact amount of tax credit that you qualify for will depend on the type of electric car that you are driving. Instead, the tax credit actually goes back to the automaker or lender financing.

The house’s current build back better plan calls for extending a $7,500 tax credit for the purchase of electric vehicles, and it includes an additional $4,500 credit for electric vehicles built in the u.s. Federal tax credit for evs jumps from $7,500 to up to $12,500. (for those that qualify) besides the generous credit for a level 2 home charger, electric car owners can also qualify for a free hov sticker.

How much is the electric vehicle tax credit for a 2021 tesla? You may be able to get a maximum of $7,500 back on your tax return. Here’s how you would qualify for the maximum credit:

As noted above, after the automaker has sold 200,000 vehicles, the credit is reduced to 50 percent of the original amount. Subject electric vehicle charging credit summary the bill provides under the personal income tax law (pitl) and corporation tax law (ctl), a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle $2,000 to $4,500 for battery electric vehicles;

Purchasing an electric car can give you a tax credit starting at $2500. Combined with the ca incentives, your savings could be huge. Keep the $7,500 incentive for new electric cars for 5 years.

You might also qualify for up to a $7,500 tax credit from the federal government. Likewise, the credit for leasing an ev will decrease to $1,500 from the current $2,000. Funds for this program may become exhausted before the fiscal year ends, but applicants will be placed on a rebate waiting list in this case.

Avoid the bothersome traffic jams of los angeles or orange county by simply applying to get your hov sticker. Keep the $7,500 incentive for new electric cars for. Is there a tax credit for buying a hybrid car or electric vehicle in 2021?

Congress is mulling over passing the build back better act, which would increase the maximum electric vehicle tax credit to $12,500 in 2022. Get more info on the electric vehicle federal tax credit. There’s some consternation among ev advocates about the.

Senior executives at 12 major international automakers on friday urged california's two u.s. Federal tax credit for evs jumps from $7,500 to $12,500. And $4,500 to $7,000 for fuel cell electric vehicles.

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

How Do Electric Car Tax Credits Work Kelley Blue Book

Latest On Tesla Ev Tax Credit December 2021 - Current And Upcoming In 2022

California Ev Incentive Is Getting Smaller In November

Good Luck With The California Electric Car Rebate Program - The San Diego Union-tribune

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate - Roadshow

Ev Incentives Ev Savings Calculator - Pge

Ev Tax Credits Could Win Over Consumers But Union Spat Remains

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

How Do Electric Car Tax Credits Work Credit Karma

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

Electric Cars Will Challenge State Power Grids The Pew Charitable Trusts

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

State And Federal Electric Vehicle Incentives Clean Vehicle Rebate Project

Electric Vehicle Tax Credits What You Need To Know Edmunds

The Ev Tax Credit Can Save You Thousands -- If Youre Rich Enough Grist

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek