It's just not worth driving 20 miles to fayette county to save 52 cents in. Tennessee bill would exempt groceries from sales tax for may through october 2021 h.b.

The Four Way - Home - Memphis Tennessee - Menu Prices Restaurant Reviews Facebook

2021 tennessee state sales tax.

Sales tax on food in memphis tn. “i think for some tennesseans this will have a major impact. California (1%), utah (1.25%), and virginia (1%). Memphis, tennessee sales tax rate details.

Memphis city rate(s) 7% is the smallest possible tax rate (38110, memphis, tennessee) 9.25% are all the other possible sales tax rates of memphis area. Visit www.tn.gov/revenue and click “revenue help.” • baby food • bottled water • bread • canned foods • cereal • chips, dips • coffee • condiments Sales tax in most places in tn is going to be between eight and ten cents on the dollar.

Memphis, tn sales tax rate the current total local sales tax rate in memphis, tn is 9.750%. Thanks to the improve act, the state sales tax rate on food and food ingredients has been reduced 20% from 5% to 4%, plus local sales tax rate. Please refer to the tennessee website for more sales taxes information.

However, manufacturers may be granted a reduced rate of 1.5% for industrial machinery or a full exemption if the energy fuel or water comes in contact with the product. Please note that the results below are for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. Counties and cities can charge an additional local sales tax of up to 2.75%, for a.

Sales or use tax [tenn. That means 9.25% (7% is the state portion and 2.25% is the local). • $1,600 x 2.25% (local sales tax) = $36 • $1,600 x 2.75% (single article tax rate) = $44 • total tax due on the vehicle = $1,851 if purchased in tennessee • minus credit for $1,518 fl sales tax paid (must be on bill of sale) •.

This tax is generally applied to the retail sales of any business, organization, or person engaged Taxed at 7%, plus local sales tax rate. The tennessee sales tax rate is currently %.

The memphis sales tax rate is %. We include these in their state sales tax. However, cities and counties can collect additional sales taxes, with local rates ranging from 1.50% to 2.75%.

The minimum combined 2021 sales tax rate for memphis, tennessee is. Accessories, furnishings, and + delivery or installation fees, are sales of food and food ingredients as defined in the law. This is the total of state, county and city sales tax rates.

Here’s how to do it right. The county sales tax rate is %. The memphis, tennessee sales tax rate of 9.75% applies to the following 50 zip codes:

There is no sales tax on food items, but prepared meals purchased in a restaurant are subject to a meal tax of 6.25% (in some towns voters chose to add a local 0.75% tax, raising the meal tax to 7%, with that incremental revenue coming back to the town). Exact tax amount may vary for different items. Electricity and natural gas are normally taxed at the rate of 7.0%;

These items are taxed at a state rate of. 1071 would exempt food items from sales tax for six months, and. 9.75% is the highest possible tax rate (37501, memphis, tennessee) the average combined rate of every zip code in memphis, tennessee is 9.346%.

37501, 37544, 38101, 38103, 38104, 38105, 38106, 38107, 38108, 38109, 38111, 38112, 38113, 38114, 38115, 38116, 38117, 38118, 38119, 38120, 38122, 38124, 38126, 38127, 38128, 38130, 38131, 38132, 38134, 38136, 38137, 38141, 38152, 38157, 38161, 38166, 38167, 38168, 38173, 38174, 38175, 38177, 38181, 38182,. The tennessee state sales tax rate is 7%, and the average tn sales tax after local surtaxes is 9.45%. The december 2020 total local sales tax rate was also 9.750%.

But if passed, food would be tax free this summer starting june 1 to july 31 cutting grocery bills by $4 for every $100 you spend. Any person, legal entity, including heirs, or assignees who have a possible ownership interest, legal or. Last sales taxes rates update

“it’s helpful, if our customers can save in their pocketbook, the 9.75 percent sales tax, and that incentivizes them to come and choose to eat out more than they would’ve,” she said. Sales or use tax (continued) there are some exceptions to the 7% general state sales or use tax rate: Sales tax reduction on utilities.

Business licenses required at all levels of government for businesses in memphis, tennessee. Water is taxed at the combined rate of 9.25%. Sales tax treatment of groceries, candy & soda, as of july january 1, 2019 (a) alaska, delaware, montana, new hampshire, and oregon do not levy taxes on groceries, candy, or soda.

Big Man Patio Chairs Outdoor Living Furniture Free Shipping No Sales Tax In Most Outdoor Patio Furniture Sets Outdoor Patio Couch Sectional Patio Furniture

Pin On Hong Kong Unique Homes

Sales Tax On Grocery Items - Taxjar

Big Leather Arm Chairs Wide 500 Lb Heavy Duty Free Shipping Save On Sales Tax No Interest Financing A Man Living Room Affordable Leather Chair Big Chair

Pin On Muebles

Welcome To Pancake Pantry Pancake Pantry Fun Cooking Breakfast Treats

Big Man Chairs Free Shipping Save On Sales Tax No Interest Financing Furniture Home Decor Man Living Room Oversized Recliner Chair

Downtown Memphis Skyline Memphis Skyline Downtown Memphis Memphis

Pin On Real Estate

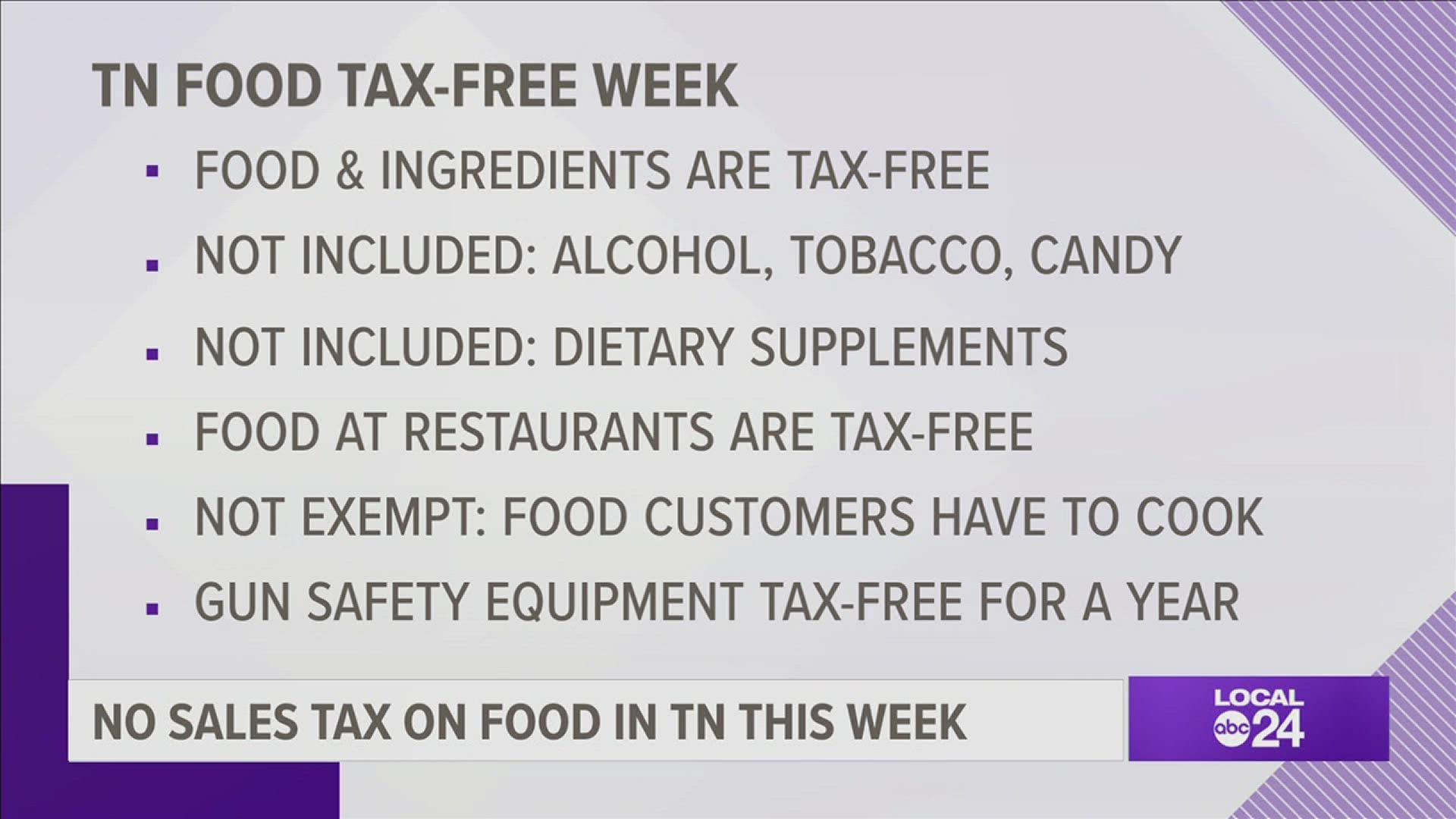

Tn Has Its First-ever Tax Free Week On Food Localmemphiscom

Tn Has Its First-ever Tax Free Week On Food Localmemphiscom

Swoosh On Sale Favorite Places Places Trip

1940s San Francisco Playlandcliff House Places To Dine At Beach Restaurant Menu 1910668039 Menu Restaurant San Francisco Cafe Menu

Bristol Va Meals Tax Among Highest Wcyb

Jackson Tennessee Food

Img_1764 Modern Restaurant Design Rustic Restaurant Modern Restaurant

Ordering This Cute Portable Chopstick Tupperware

Pin On Weight Loss Arm Bands

Sales Tax On Grocery Items - Taxjar