Everyone in utah is eligible to take a personal tax credit when installing solar panels. In 2019, this credit covers 30 percent of solar costs.

2021 Solar Panel Costs Average Installation Cost Calculator

Utah — you can claim 25 percent of your photovoltaic costs, up to $1,600, if you.

Utah state solar tax credit 2019. Customers who live in utah and south carolina may also qualify for a state solar tax credit in addition to the federal solar tax credit. Steps for utilizing the utah solar tax credit: Renewable energy systems tax credit.

Starting in 2021, it will resume its yearly phase down until this tax credit reaches zero at the end of 2023. The utah solar tax credit, officially known as the renewable energy systems tax credit, covers up to 25% of the purchase and installation costs for residential solar pv projects, capped at $1,600, whichever is less. And of course, utahns also benefit from the federal solar tax credit.

$1,600 is the maximum amount of credit you can get for solar in the state of utah and all our systems qualify for the maximum credit. A residential system's tax credit is 25 % of the cost of buying and installing the system, up to a maximum of $2,000. Write the code and amount of each nonapportionable nonrefundable credit in part 4.

Create an account with the governor’s office of energy development (oed) complete a solar pv application; As of 2019, utah was 10th on seia’s national solar rankings, up from 27th the year before. These incentives will start to step down beginning in 2020.

For each qualifying system, you can claim up to 25 percent of the costs, with a maximum claim of. Claiming this credit now is ideal because after 2019 it will decrease to 26 percent. Enter the following nonapportionable nonrefundable credits that apply.

Keep in mind that the itc applies only to those who buy their pv system outright (either with a cash purchase or solar loan), and that you must have enough income for the tax credit be meaningful. Claim the renewable residential energy system credit; Fill out the rest of the form as you normally would when filing your state taxes.

Renewable energy is on the rise in the state of utah. Utah state tax commission 210 north 1950 west • salt lake city, utah 84134 tax.utah.gov. You can claim the state credit for more than one system, as long as each one is installed on a residential unit that you own or use.

Utah solar customers would be wise to invest in solar before the available funding is no longer within their reach. The average cost for a 5 kilowatt (kw) solar installation in utah is $14,075 and $10,416 after the federal tax credit. This credit is for reasonable costs, including installation, of a residential energy system that supplies energy to a utah residential unit.

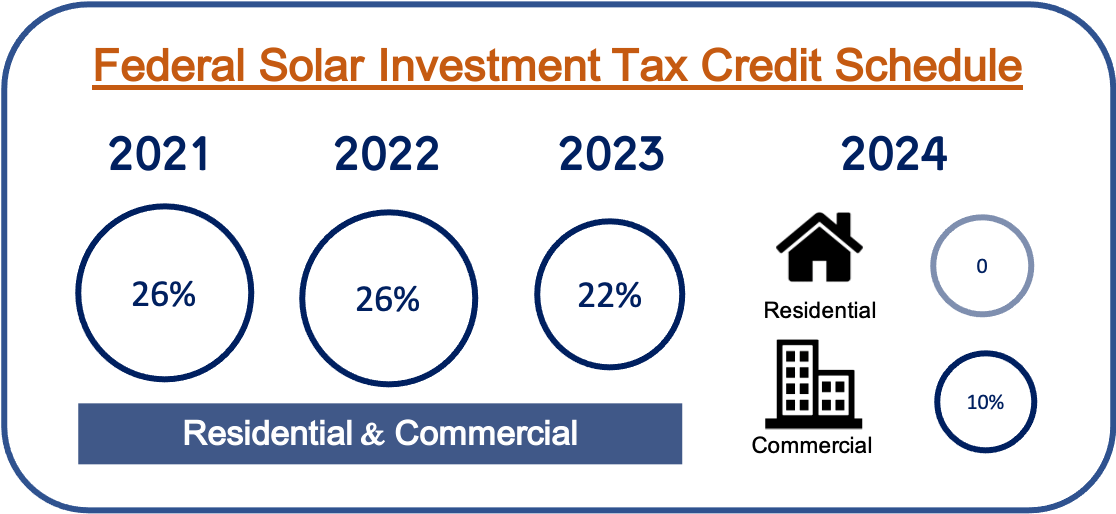

Total the amounts and carry the total. Go solar today and claim your 30% tax credit incentive! With the investment tax credit (itc), you can reduce the cost of your pv solar energy system by 26 percent.

It credits utahan’s $1,600 toward state taxes that would have been owed. Shop around by checking with your financial institution about traditional financing options. Rooftop solar installations are eligible for a 30% federal tax credit and a 25% state tax credit (capped at $1,600).

The federal solar incentive, also known as the itc, is a solar tax credit. With the new law that credit will steadily be reduced by $400 per year until it’s completely eliminated entirely after 2021. You can claim 25 percent of your total equipment and installation costs, up to $1,600.

The solar itc in utah isn’t limited to one photovoltaic system, either. Utah renewable energy systems tax credit (restc) program Install a solar energy system;

Where do i enter the information to receive the utah state tax credit for solar? You might have heard of the utah state initiative as the renewable energy system tax credit (restc) program. The state solar incentive is also a tax credit.

So, the big question is — how much can you save with the utah solar itc? Nonapportionable nonrefundable credits can reduce your income tax to zero, but any credit greater than your tax liability will not be refunded. The bill extends the cap on the maximum credit each residential solar system can claim under the 25% solar tax credit by two years.

Have the ability to claim the utah state solar tax credit (residential) in the amounts of $1,600 in 2018, 2019, and 2020, pending approval of proposed legislation. In utah, you can claim up to $1,600 in tax credits for switching to solar energy. If you install a solar panel system on your home in utah, the state government will give you a credit on your next year’s income taxes to reduce your solar costs.

Utah 2019 all state income tax dollars fund education. Learn more and apply here. States in the intermountain west region that offer solar tax credits include:

Additional residential energy systems or parts may be claimed in following years as long as the total amount claimed does not exceed certain limits. Utah’s solar tax credit currently is frozen at $1,600, but it won’t be for long. Utah governor gary herbert signed a new bill into law (sb 141) that grants an extension to the state’s solar tax credit.

Newable residential energy systems credit (credit 21) for solar power systems installed in 2019 is $1,600. The tax credit for a residential system is 25% of the purchase and installation costs up to a maximum of $1,600. In utah, you can claim up to $1000 in tax credits for switching to solar energy.

To use the 25% of the eligible system cost or $1,600 credit until 2021, you will need an account with the governor’s office of.

Gravity Storage Innovative Solution To Increase The Reliability Of Solar Energy At The Forefront Of Technologi Renewable Sources Of Energy Solar Solar Energy

Understanding The Utah Solar Tax Credit Ion Solar

Solar Energy Expansion In The Middle East And Its Socioeconomic Download Scientific Diagram

Sample Conceptual Design Of Solar Pv On A Closed Landfill 4 Download Scientific Diagram

Watercolor Wonder Art Pad Planner Art Create Wall Art

Perseverance Always Wins The Race Tactical Gloves Tactical Wallet Tactical Backpack

Solar Incentives In Utah - Utah Energy Hub

Free Pattern In My Blog Here In English Y Espanol Httpswwwmammadiyes20200126the-traveling-crochet-afghan In 2021 Crochet Squares Afghan Crochet Afghan Crochet

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive Pennsylvania

How Solar Works Solar Energy Facts Solar Panels Facts Solar

Understanding The Utah Solar Tax Credit Ion Solar

108kw Ground Mount Idaho Solar Roof Solar Panel Idaho

Holiday Inn Will Stop Providing Mini Plastic Toiletries To Help Save The Oceans Reduce Plastic Waste Plastic Plastic Waste

Understanding The Utah Solar Tax Credit Ion Solar

How Much Do Solar Panels Cost In 2021 Energysage

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

Comparative Data Of Saudi Arabia And Other Gcc Countries For Re Solar Download Scientific Diagram

Intersolar Europe Webinar This Webinar Was About New Market Perspectives For Large-scale Pv Installations In Germany A Solar Energy Science And Nature Solar

Top 10 Solar States Seia Solar Solar Electric States