Income statement or an excel spreadsheet, please send that to us along with the required sections below ( in red ). Ya 2020 (xls, 1.20mb) ya 2019 (xls, 0.97mb)

Canadian Sales Tax Calculator - Windows 10 Download

This calculator template is prepared in ms excel format.

S corp tax calculator excel. On this page you will find: This tax calculator shows these values at the top of. *for filing an s corp only:

Click here to download the mba excel tax liability estimator. File irs form 2553, which elects your corporation to become an s corp. Completing a tax organizer will help you avoid overlooking important information and contribute to an efficient preparation of your tax returns.

For losses and deductions which exceed a shareholders stock basis the shareholder is allowed to deduct the excess up to the shareholders basis in loans personally made to the s corporation see item 4 below. Therefore, use the accompanying excel template to complete a comprehensive federal tax analysis at four levels of business income ($100,000, $200,000, $400,000, and $600,000). This calculator helps you estimate your potential savings.

From the authors of limited liability companies for dummies. S corp tax calculations, you can post your legal need on upcounsel's marketplace. I have a client who is a schedule c and i am in the midst of converting him to a s.

The standard deduction for your filing marital status. This calculation is only valid if your business income is $132,000. As jayne's tax adviser, you should provide a dynamic tax analysis, being mindful of how each federal tax levy will change if jayne's business grows in the future.

Prior years tax returns ‐ if you are a first‐time tax client, please provide a copy of the corporation's tax returns for the past 3 years (federal and state). Ya 2021 (xls, 1.30mb) new! Lawyers on upcounsel come from law schools such as harvard law and yale law and average 14 years of legal experience, including work with or on behalf of companies like.

*works best with microsoft office excel 2007 or later version, incompatible with microsoft office excel for mac. The s corporation tax calculator below lets you choose how much to withdraw from your business each year, and how much of it you will take as salary (with the rest being taken as a distribution.) it will then show you how much money you can save in taxes. For example, if you have a business that earns $200 in revenue and has $75 in expenses, then your taxable income is $125.

The template contains all those details which are needed by the user to calculate the corporate tax. Make sure that this is signed by all shareholders and submitted within 75 days of your corporation formation. How s corps create savings.

The s corp tax calculator. Your annual federal business tax return is due march 15th instead of april 15th. Ms excel can be easily converted into a calculator by defining some formulas related to what you want to calculate.

Here is a calculator which allows you to calculate what your effective tax rate would be for each type of business entity. An s corp basis worksheet is used to compute a shareholders basis in an s corporation. Upcounsel accepts only the top 5 percent of lawyers to its site.

There is not a simple answer as to what entity is the best in terms of incorporation. If you need help with llc vs. Excel) where i can plug in the figures (i.e.

Now, if $50 of those $75 in expenses was related to meals and. The use of this template ensures that. There are only two pieces of information required from the irs:

Check the calculation to verify your underpayment status. Our small business tax calculator has a separate line item for meals and entertainment because the irs only allows companies to deduct 50% of those expenses. As a sole proprietor self employment taxes paid as a sole proprietor.

*step 7 is only required if you’re creating an s corp. Llc, s corp, small business worksheet. Enter the required irs information.

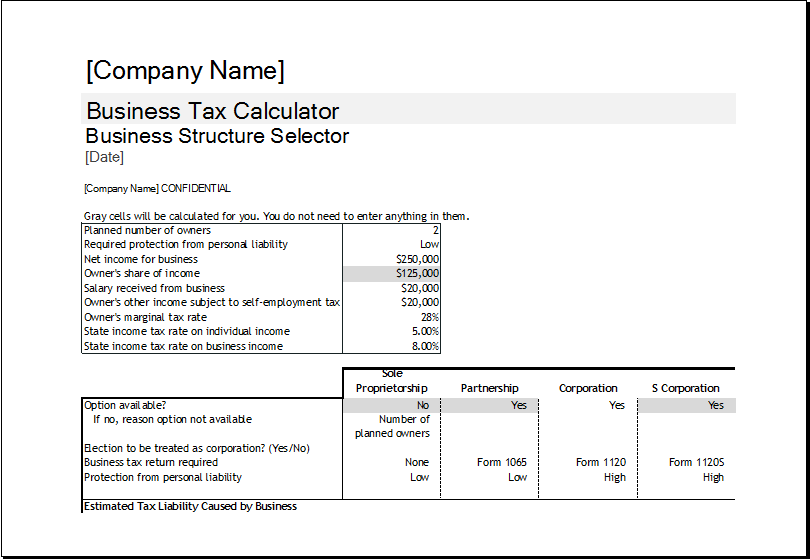

Bookkeeping records ‐ if you use a bookkeeping system other than xero, you can provide us with a The entity compares tax rates across s, c, and limited liability corporations. Does anyone have some kind of financial calculator (i.e.

The initial debt basis is the amount of money loaned. S corps create tremendous savings because they reduce the biggest expense many llc owners face: The tax brackets for your filing marital status.

Download Adjusted Gross Income Calculator Excel Template - Exceldatapro Adjusted Gross Income Income Federal Income Tax

Free Tax Estimate Excel Spreadsheet For 201920202021 Download

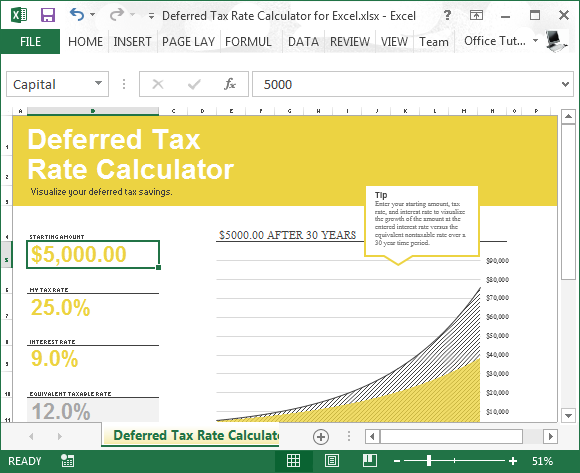

Deferred Tax Rate Calculator For Excel

Calculate Gross Margin On A Product Cost And Selling Price Including Profit Margin And Mark Up Percentag Price Calculator Financial Calculators Pricing Formula

This Spreadsheet Could Help You Save Over 5000 In Taxes Small Business Bookkeeping Business Tax Business Tax Deductions

Budget 2019 - Revised Section 87a Tax Rebate - Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

How To Calculate Sales Tax In Excel

Pin En Calculo Isr Con Excel

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Free Daily Sales Report Excel Template 1 - Templates Example Templates Example Sales Report Template Report Template Excel Templates

Corporate Tax Calculator

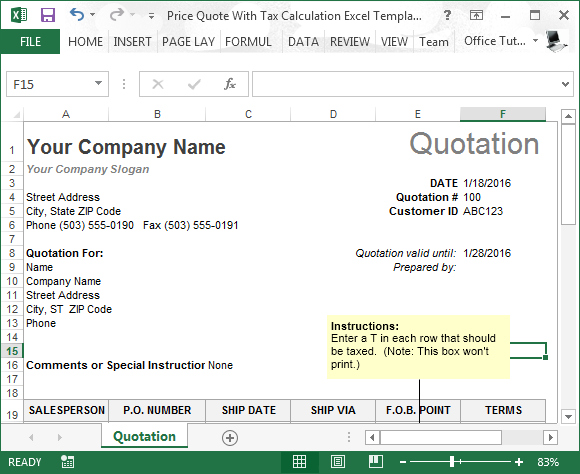

Price Quote With Tax Calculation Template For Excel

S Corp Tax Calculator - Llc Vs C Corp Vs S Corp

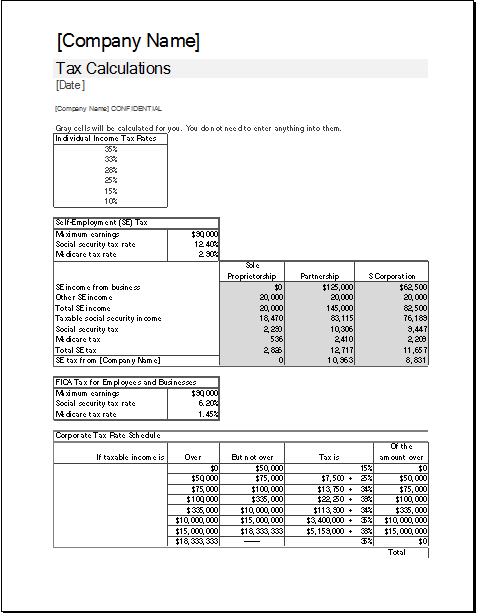

Corporate Tax Calculator Template For Excel Excel Templates

Corporate Tax Calculator Template For Excel Excel Templates

Federal Income Tax Fit - Payroll Tax Calculation - Youtube

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

S-corporation Tax Calculator Spreadsheet--when How The S-corp Can Save Taxes Vs Sole-proprietor - Youtube