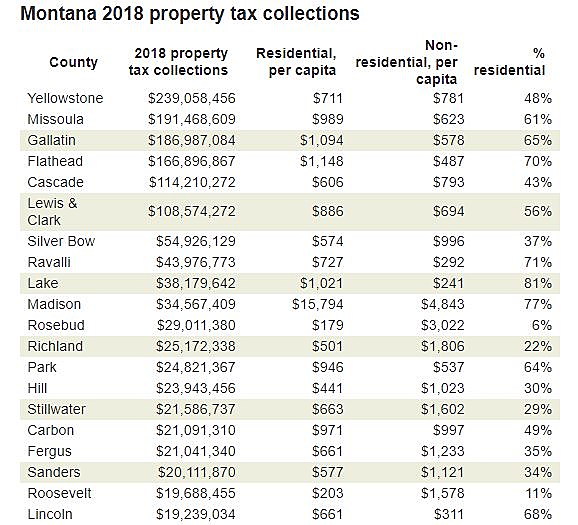

The december 2020 total local sales tax rate was also 0.000%. Figures presented to lawmakers last month indicate the answer varies widely across different parts of the state, ranging from as low as $125 annually per capita in mccone county to as high as $15,794 per capita in madison county.

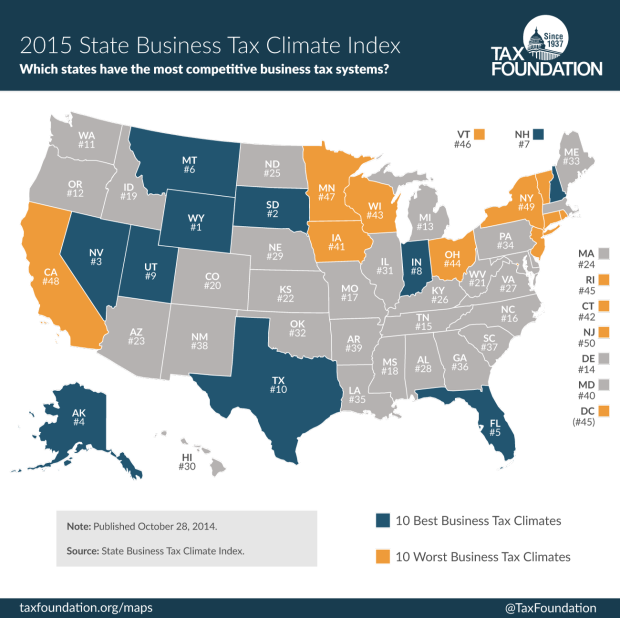

Report Ranks Montana 6th In Nation For Business Tax Climate Local Ravallirepubliccom

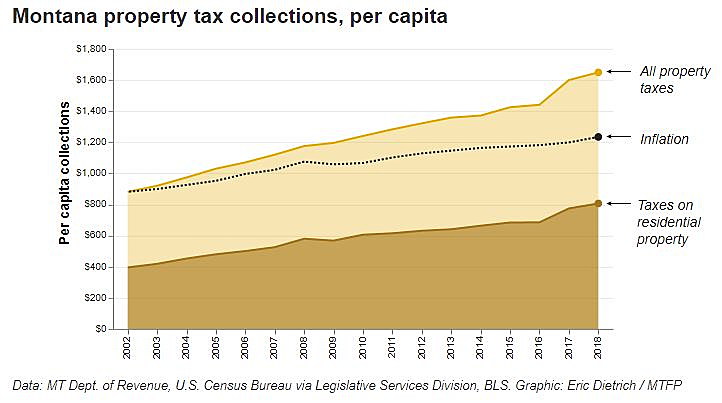

(montana free press) just how hard do montana cities, counties and school districts lean on residential property taxes to fund government services?

Missoula montana sales tax rate. The us average is 7.3%. The 2018 united states supreme court decision in south dakota v. The combined rate used in this calculator (0%) is the result of the montana state rate (0%).

The montana sales tax rate is currently %. The missoula, montana sales tax is n/a, the same as the montana state sales tax. There is no city sale tax for missoula.

These homeowners saw a 6.5% year over year increase, which is 1.5 percentage points higher than montana’s yearly average. Sales is under consumption taxes. Use leading seo & marketing tools to promote your store.

There is 0 additional tax districts that applies to some areas geographically within missoula. Missoula county, and lewis and clark county. Instead of the rates shown for the missoula tax region above, the following tax.

The exact property tax levied depends on the county in montana the property is located in. Every 2021 combined rates mentioned above are the results of montana state rate (0%). Property taxes paid in montana are based on three components—the value of a property, the tax rate.

There is no county sale tax for missoula, montana. Local taxing jurisdictions (local schools, missoula county, and the city of missoula) set their budgets and send millage rate information to missoula county, which mails tax bills for all jurisdictions. Ad earn more money by creating a professional ecommerce website.

The bills are mailed in october and taxes are due. Sales is under consumption taxes. Ad earn more money by creating a professional ecommerce website.

Start yours with a template!. Tax rates last updated in september 2021. The county sales tax rate is %.

The minimum combined 2021 sales tax rate for missoula, montana is. The missoula county sales tax rate is %. Missoula’s problems are even worse when compared to property tax increases nationally, which increased at an average rate of 3.2% between 2016 and 2020.

There is no sales tax for 59802, missoula, montana. Missoula has seen the job market increase by 0.3% over the last year. The montana state sales tax rate is 0%, and the average mt sales tax after local surtaxes is 0%.

In that same time period, the average rent increased from $862 to $1,098, an increase of over 27%. Sales tax and use tax rate of zip code 59812 is located in missoula city, missoula county, montana state. There are 2 treasurer & tax collector offices in missoula county, montana, serving a population of 114,231 people in an area of 2,593 square miles.there is 1 treasurer & tax collector office per 57,115 people, and 1 treasurer & tax collector office per 1,296 square miles.

By 2021 their bill increased 90.3% to $4,054.39. In montana, missoula county is ranked 48th of 56 counties in treasurer & tax collector offices per capita, and 9th of 56. Let more people find you online.

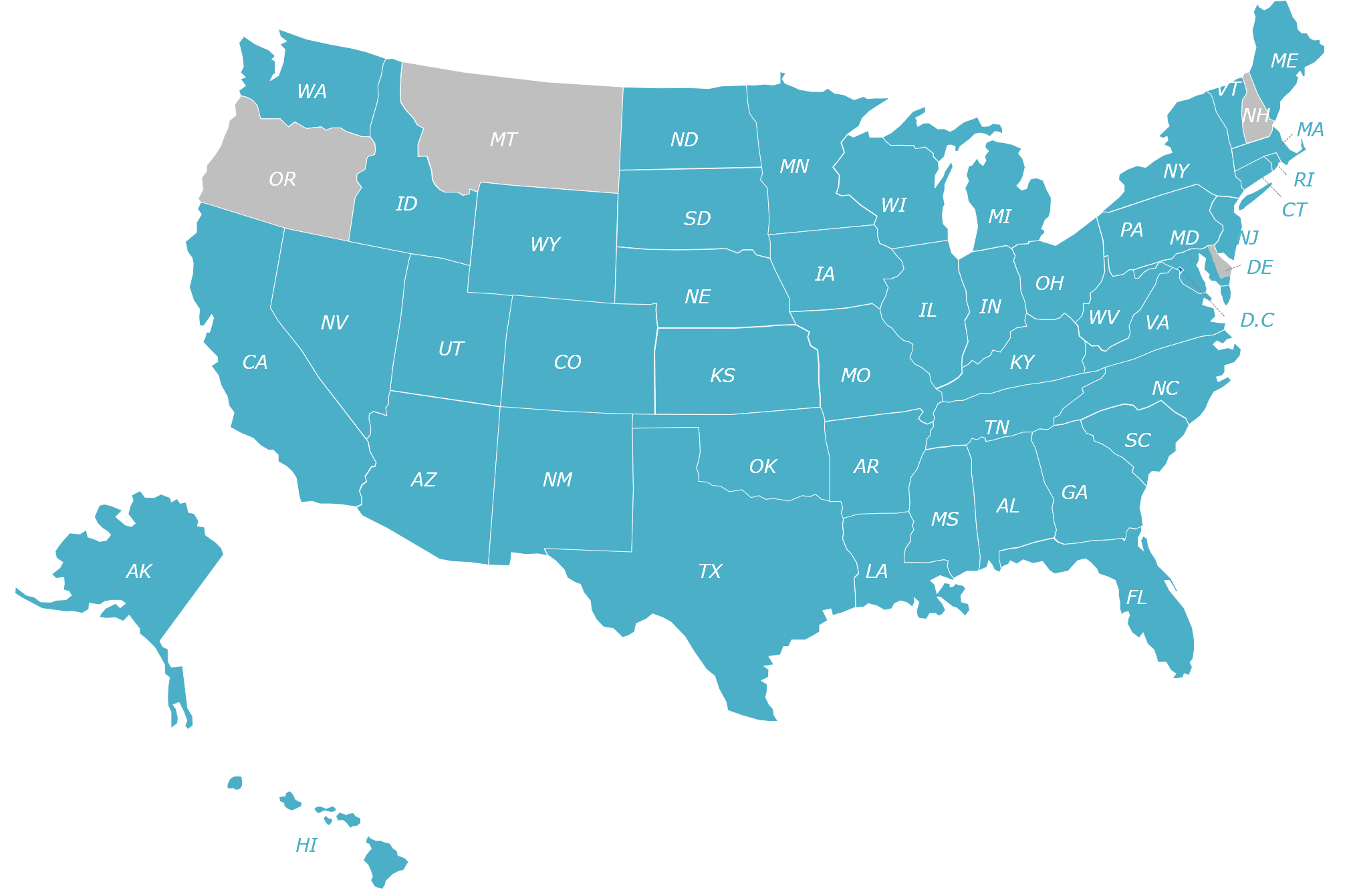

While many other states allow counties and other localities to collect a local option sales tax, montana does not permit local sales taxes to be collected. The local sales tax rate in missoula county is 0%, and the maximum rate (including montana and city sales taxes) is 0% as of october 2021. The state sales tax rate in montana is 0.000%.

The missoula, montana, general sales tax rate is 0%. The missoula sales tax rate is %. Let more people find you online.

Start yours with a template!. The median property tax in missoula county, montana is $2,176 per year for a home worth the median value of $233,700. Use leading seo & marketing tools to promote your store.

Missoula, mt sales tax rate. The sales tax rate is always 0%. This is the total of state, county and city sales tax rates.

Montana needs to fully overhaul the tax structure and if that involves a. The median home sales price in the missoula. Has impacted many state nexus laws and sales tax collection requirements.

Future job growth over the next ten years is predicted to be 33.0%, which is lower than the us average of 33.5%. The current total local sales tax rate in missoula, mt is 0.000%. There are no local taxes beyond the state rate.

Sales tax and use tax rate of zip code 59803 is located in missoula city, missoula county, montana state. There are no local taxes beyond the state rate. Local government property taxes grew at a rate of 6.119% per year on average between ty 2001 and.

Montana Property Taxes Keep Rising But Missoula Isnt At The Top - Missoula Current

Montana Property Taxes Keep Rising But Missoula Isnt At The Top - Missoula Current

Montana Income Tax Mt State Tax Calculator Community Tax

Lv No Sales Tax English As A Second Language At Rice University

Missoula Montana Sales Tax Rate - Sales Taxes By City

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax State Tax Tax

Ron Drzewuckis Bullion Sales Tax Series State By State Pt 3

Montana State Taxes Tax Types In Montana Income Property Corporate

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

State Taxes

Montana State Taxes Tax Types In Montana Income Property Corporate

Nomad States The Latest On Sales Tax

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

State Taxes

Missoula Business Owners See Benefits Of Sales Tax But Worry About Effect On Shoppers - Missoula Current

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

State Taxes

Missoula Business Owners See Benefits Of Sales Tax But Worry About Effect On Shoppers - Missoula Current

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana Property Tax Calculator - Smartasset

Rates Reservations Rivers Edge Canoe Kayak Outfitters Canoe And Kayak Kayaking Canoe

Lv No Sales Tax English As A Second Language At Rice University