Texas has one of the highest average property tax rates in the country, with only thirteen states levying higher property taxes. Your average tax rate is 16.9% and your marginal tax rate is 29.7%.this marginal tax rate means that your immediate additional income will be taxed at this rate.

Florida Property Tax Hr Block

Payroll taxes in texas are relatively simple because there are no state or local income taxes.

Texas estate tax calculator. This tax can be charged at the state, county, or municipal level and is often included as part of the seller’s closing costs, but can be paid by the buyer as well. Uncover the hidden tax benefits related to rental property ownership. Questions answered every 9 seconds.

The median property tax in texas is $2,275.00 per year for a home worth the median value of $125,800.00. This calculator helps you to calculate the tax you owe on your taxable income. Questions answered every 9 seconds.

Use this calculator to project the value of your estate, and the associated estate tax, for the next ten years. There are no inheritance or estate taxes in texas. The texas tax calculator is updated for the 2021/22 tax year.

Other notable taxes in texas. Ad a tax advisor will answer you now! 254 rows texas property taxes.

This link opens in a new window. Counties in texas collect an average of 1.81% of a property's assesed fair market value as property tax per year. Texas has an oyster sales fee.

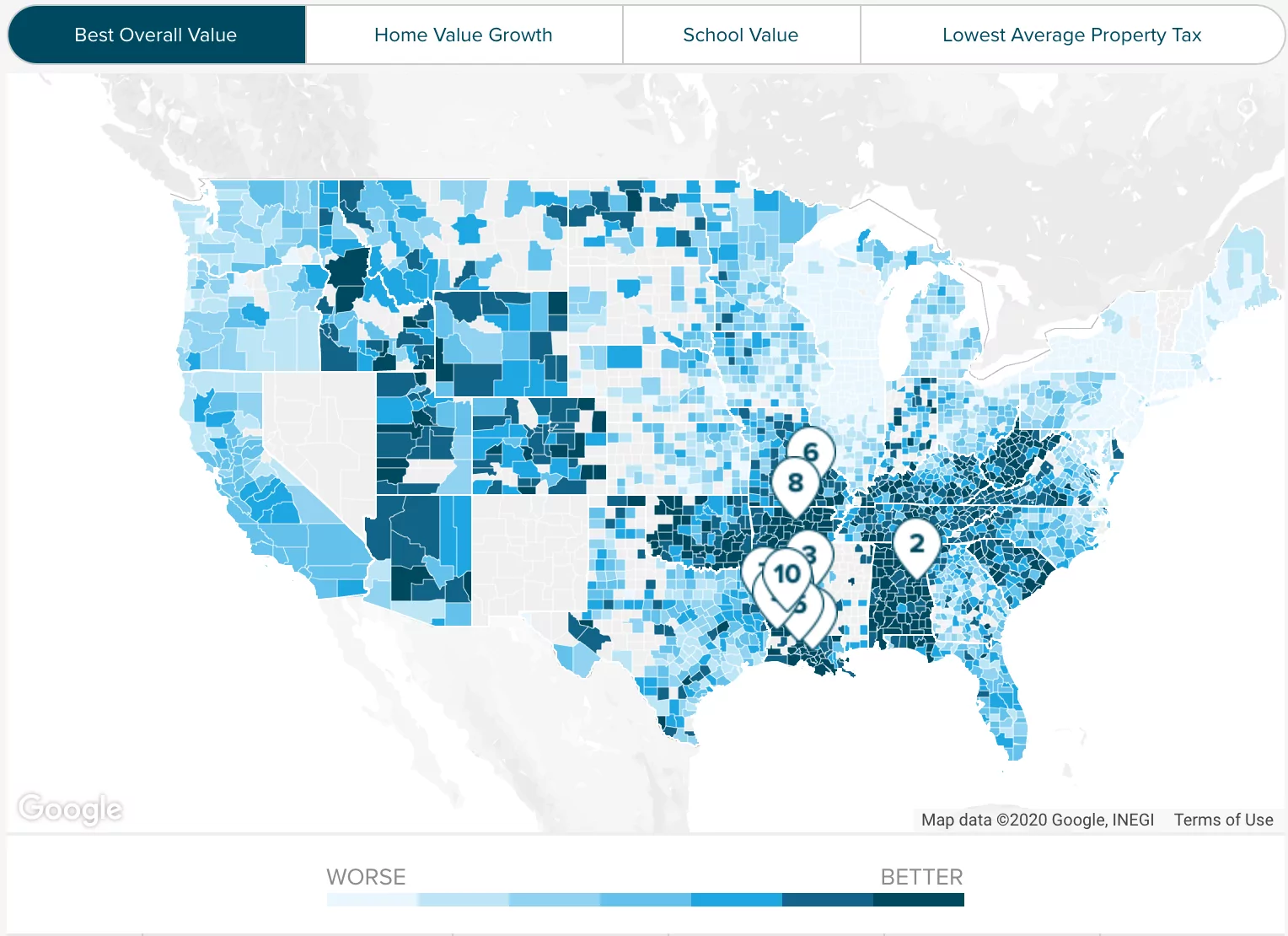

Ad a tax advisor will answer you now! Our texas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in texas and across the entire united states. The lone star state has a property tax rate of 1.83% which is quite a bit higher than the national average rate of 1.08%.

The typical texas homeowner pays $3,390 annually in property taxes. This means that if the marginal tax bracket you’re in is 22% and your rental income is $5,000, you’ll end up paying $1,100. The property tax estimator will show you the estimated taxes assessed in a given area of travis county.

If you make $55,000 a year living in the region of texas, usa, you will be taxed $9,295.that means that your net pay will be $45,705 per year, or $3,809 per month. Use the real estate transfer tax calculator below to find out how much your real estate transfer tax would cost. Compare that to the national average, which currently stands at 1.07%.

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. This tax calculator performs as a standalone state tax calculator for texas, it does not take into account federal taxes, medicare decustions et al. Texas has a 6.25% statewide sales tax rate , but also has 815 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.377% on top.

Enter your property details below to calculate your tax liability. Online texas property tax calculator. What is the estate tax?

Texas does not levy an estate tax. Rate information for all jurisdictions in accordance with texas property tax code section 26.16 is available at traviscountytx.gov. That said, you will likely have to file some taxes on behalf of the deceased, including:

The state repealed the inheritance tax beginning on september 1, 2015. Each are due by the tax day of the year following the individual’s death. To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price).

Rental income is taxed as ordinary income. The estate tax, sometimes referred to as the “death tax,” is a tax levied on the estate of a recently deceased person before the money passes on to their heirs.it only applies to estates that reach a certain threshold. It is one of 38 states with no estate tax.

This amount changes each tax year, but is determined in accordance with state law. The property tax in texas applies to all real property and some tangible personal property in the state. 256 rows texas estate tax.

1, 2005, there is no estate tax in texas. The property tax is used to finance the state’s 254 counties, over 1,200 cities, 1,022 independent school districts, and more than 1,800 special districts. Here's the math we used to calculate that tax payment:

Texas property tax rates are among the highest in the united states. Shellfish dealers in texas are required to pay a tax of $1 per 300 pounds of oysters taken from texas waters. This calculator uses the rules passed into law as part.

This calculator can help you figure out how much you’ll be inheriting after probate, as well as how much you’ll be paying in estate taxes. In the fields provided, enter all the necessary information about the. Knowing your potential estate tax liability is a great place to start your estate tax plan.

Final individual federal and state income tax returns: The texas tax calculator is designed to provide a simple illlustration of the state income tax due in texas, to view a comprehensive. Estate tax planning is very important to preserving your wealth for future generations.

Free estate tax calculator to estimate federal estate tax in the u.s.

Texas Retirement Tax Friendliness - Smartasset

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

State Taxes

Harris County Tx Property Tax Calculator - Smartasset

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Income Tax Calculator - Smartasset

New Mexico Property Tax Calculator - Smartasset

Harris County Tx Property Tax Calculator - Smartasset

Texas Income Tax Calculator - Smartasset

Texas Paycheck Calculator - Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

King County Wa Property Tax Calculator - Smartasset

How To Create A Living Trust In Texas - Smartasset

25 Percent Corporate Income Tax Rate Details Analysis

The States With The Highest Capital Gains Tax Rates The Motley Fool

Paying Taxes On A Home Sold After A Spouses Death Kiplinger

Texas Property Tax Hr Block

Texas Income Tax Calculator - Smartasset

Harris County Tx Property Tax Calculator - Smartasset