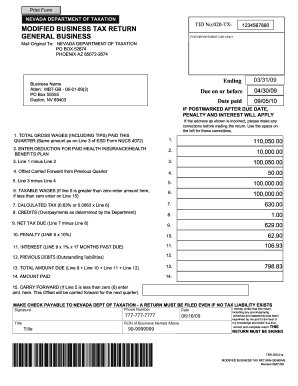

Create and account and follow the prompts to register your business. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

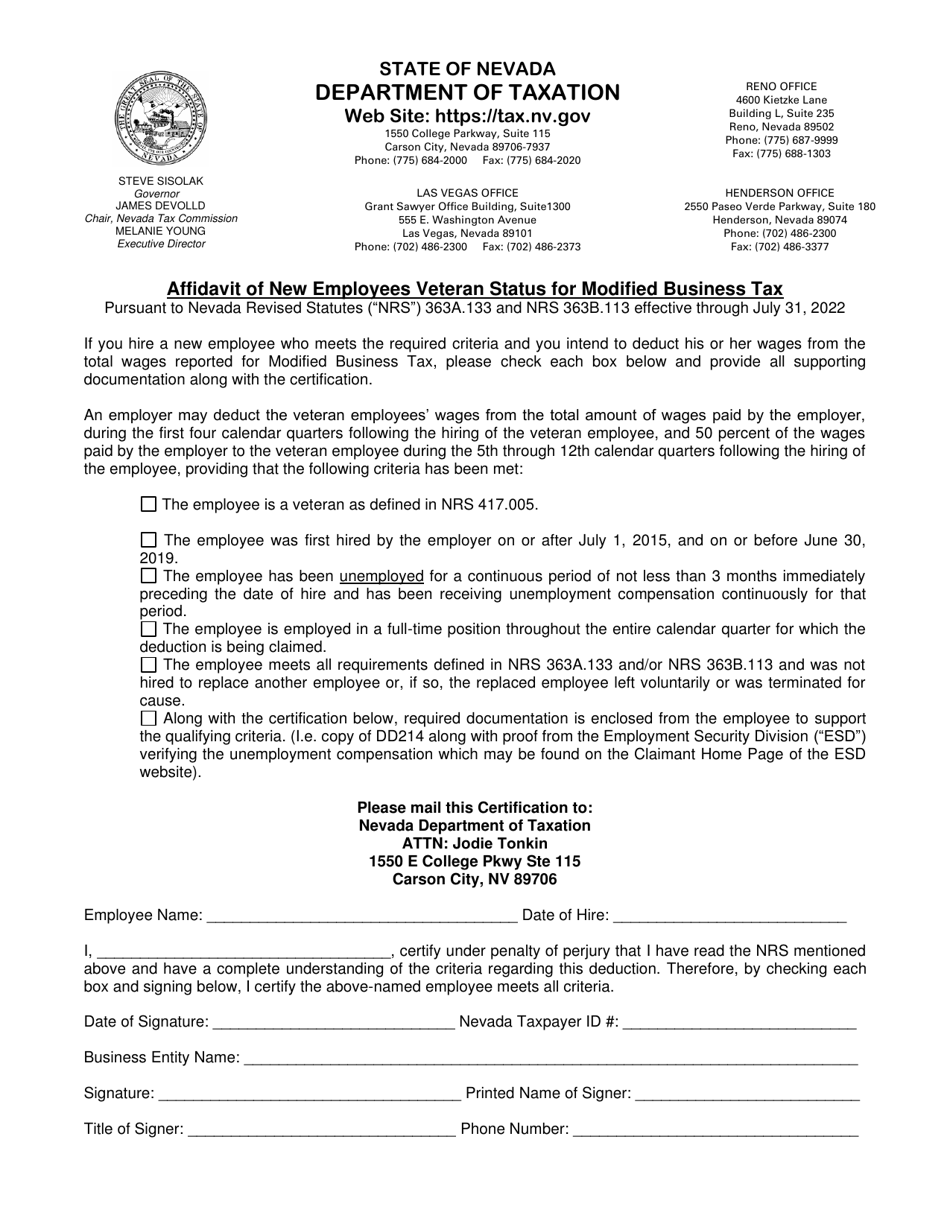

Nevada Affidavit Of New Employees Veteran Status For Modified Business Tax Download Fillable Pdf Templateroller

Lawmakers voted in 2015 to raise the mbt rate but to sunset that increase in 2019 if the department of taxation confirmed that actual revenues exceeded projections by a certain amount.

Modified business tax rate nevada. Modified business tax has two classifications: The modified business tax is described by the nevada department of taxation as a quarterly payroll tax. Senate bill 153 includes changes to the state’s sales and use tax code, including the adoption of an economic nexus threshold effective january 1, 2023.

Some 22,621 taxpayers who paid a higher tax rate due to the passage of senate bill 551 during the 2019 legislative session were refunded $3.06 million, which includes. Nevada corporations still, however, have to pay the federal corporate income tax. Nevada modified business tax rate.

Effective july 1, 2019 the tax rate changes to 1.853% from 2.0%. Nevada has no corporate income tax at the state level, making it an attractive tax haven for incorporating a business. Taxation confirmed that mbt revenues hit and beat that mark in 2018, triggering the reduction.

Nevada (modified business tax rate) kpmg’s this week in state tax—produced weekly by kpmg’s state and local tax practice—focuses on recent state and local tax developments. 1 one bill extended corporate payroll tax rate increases under the state’s modified business tax. Modified business tax has two classifications:

Nevada revised statute 363b.120 provides an abatement of the modified business tax for qualifying businesses. If you reported payroll over $50,000 in any of the above listed quarters, you will likely be receiving a notification from the nevada department of taxation. The mbt rate is 1.17 percent.

The nevada supreme court recently held that a nevada law that repealed a previously legislated reduction of the modified business tax (mbt) rate was unconstitutionally enacted. The department is developing a plan to reduce the modified business tax rate for quarters ending september 31, 2019 through march 31, 2021 and will be announcing when refunds will be issued soon. Effective july 1, 2005, a partial abatement of tax during the initial period of operation is available.

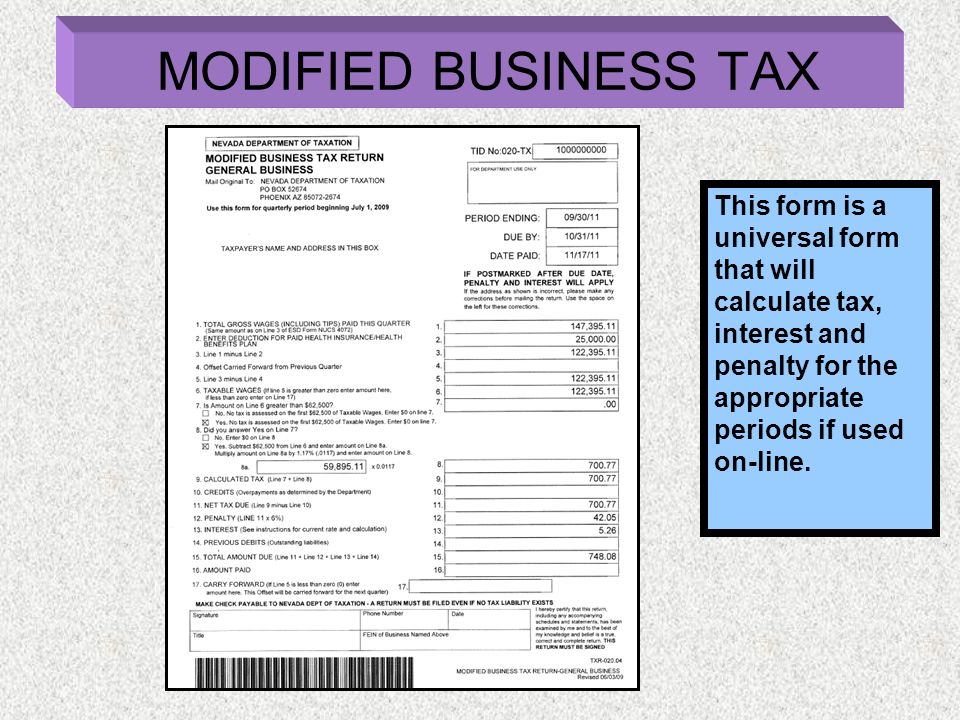

The nevada department of taxation has sent out the first round of refund checks to businesses that paid a tax recently struck down by the state’s supreme court as being unconstitutional. Nevada corporate income tax brackets. It is assessed if taxable wages exceed $62,500 in a quarter.

I cannot figure out how to change this rate. Once completed you will receive your account number and rate. A modified business tax (excise tax) is imposed on each employer at the rate of 0.63% of the wages.

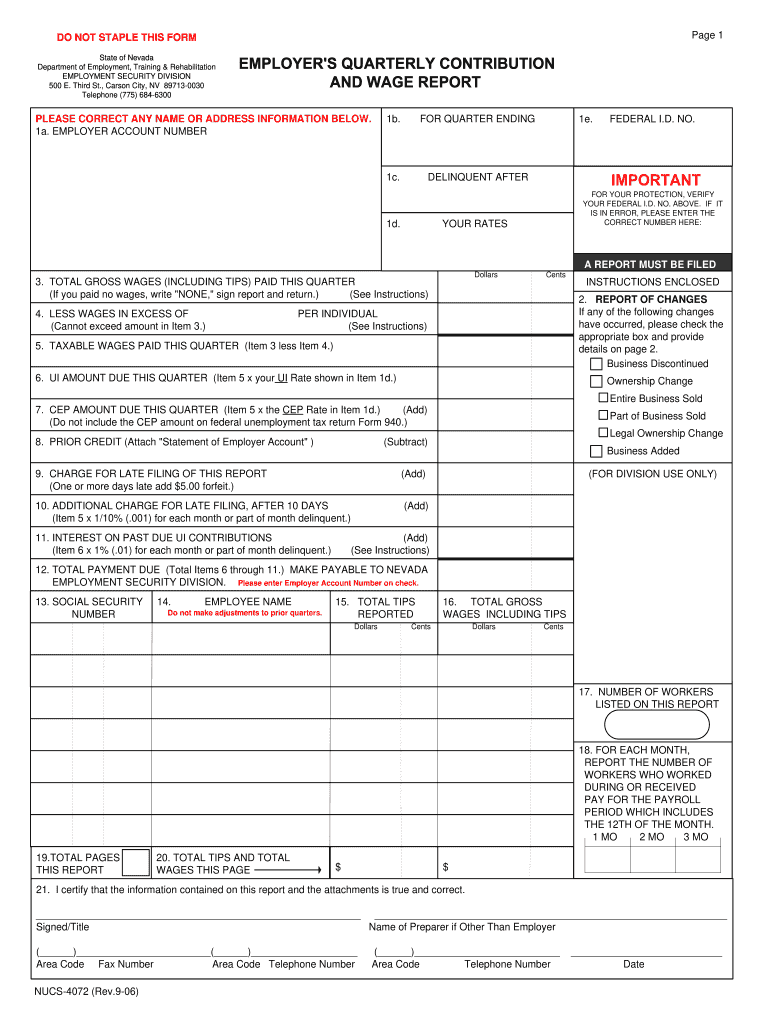

Select the register ne business for ui tax under the i want to options. Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter. Tax bracket (gross taxable income) tax rate (%) $0+.

Qualifying employers are able to apply for an abatement of 50 percent of the tax due during the initial four years of its operations. Qualifying employers may apply for an abatement of 50% of the tax otherwise due during the first four years of its operations. If your business has taxable wages that exceed $62,500 in a quarter, then the mbt is.

According to the court, a bill that was passed during 2019, which prevented the previously scheduled automatic tax rate reduction form going into effect, is invalid. However, the first $50,000 of gross wages is not taxable. Exceptions to this are employers of exempt organizations and employers with household employees only.

Nevada state corporate income tax 2021. I file this online but i want to change the tax rate on quickbooks desktop so the guide form in quickbooks is correct. The modified business tax (mbt) is considered a payroll tax based on the amount of wages paid out in a quarter.

In general, every employer that is subject to payment of nevada unemployment tax is also subject to the mbt, which is imposed on total gross wages less employee health care benefits. Modified business tax has two classifications: This is the standard quarterly return for reporting the modified business tax for businesses who are subject to the tax on the net proceeds of minerals imposed pursuant to nrs 362.

The mbt rate is 1.17 percent. • the new modified business tax rates for fy20, as calculated pursuant to nrs 360.203, are 1.378%for general business and 1.853% for mining and financial institutions. General business \u2013 the tax rate for most general business employers, as opposed to financial institutions, is 1.475% on wages after deduction of health benefits paid by the employer and certain wages paid to qualified veterans.

The nevada supreme court determined the modified business tax (mbt) rate should have been reduced on july 1, 2019.

2

2

2

2

Ms Form Ui 3 - Fill Online Printable Fillable Blank Pdffiller

2

2

Nevada Department Of Taxation Forms Pdf Templates Download Fill And Print For Free Templateroller

Nv Dot Nucs-4072 2006-2021 - Fill Out Tax Template Online Us Legal Forms

2

Nevada Affidavit Of New Employees Veteran Status For Modified Business Tax Download Fillable Pdf Templateroller

First Round Of Nevada Modified Business Tax Refunds Issued Serving Northern Nevada

Nevada Legislation To Repeal Reduction Of Modified Business Tax Rates Required Supermajority Vote

2

What Is The Business Tax Rate In Nevada

Nevada Legislation To Repeal Reduction Of Modified Business Tax Rates Required Supermajority Vote

What Is The Business Tax Rate In Nevada

2

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation - Ppt Download