Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. Immediate relatives, such as children, are also often exempt or pay some of the lowest inheritance tax rates.

State Estate And Inheritance Taxes Itep

Inheritance tax is imposed on the value of the decedent’s estate that exceeds the exemption amount applicable to the decedent’s year of death.

Do you have to pay taxes on inheritance in tennessee. No estate tax or inheritance tax. The top inheritance tax rate is 15 percent (no exemption threshold) rhode island: A tax advisor will answer you now!

State rules usually include thresholds of value—inheritances that fall below these exemption amounts aren't subject to the tax. Those who handle your estate following your death, though, do have some other tax returns to take care of, such as: Spouses, for example, are always exempt from paying inheritance taxes.

Most of the time, only big estates feel the bite of. There’s normally no inheritance tax to pay if either: The top estate tax rate is 16 percent (exemption threshold:

The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. For example, let's say a family member passes away in an area with a 5% estate tax and a 10% inheritance tax. The taxes that other states call inheritance taxes are not based on the total value of the estate.

The maximum tax rate ranged from 9.5 percent in tennessee to 18 percent in maryland. The articles below constitute “published guidance,” as defined in tenn. Ad questions answered every 9 seconds.

The department of revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those laws. No estate tax or inheritance tax There is a chance, though, that another state’s inheritance tax will apply if you inherit something from someone who lives in that state.

The inheritance tax is levied on an estate when a person passes away. No estate tax or inheritance tax. The inheritance tax is paid out of the.

The value of your estate is below the. In nebraska, you have 12 months to pay what you owe or interest may be applied to. Tennessee inheritance and gift tax.

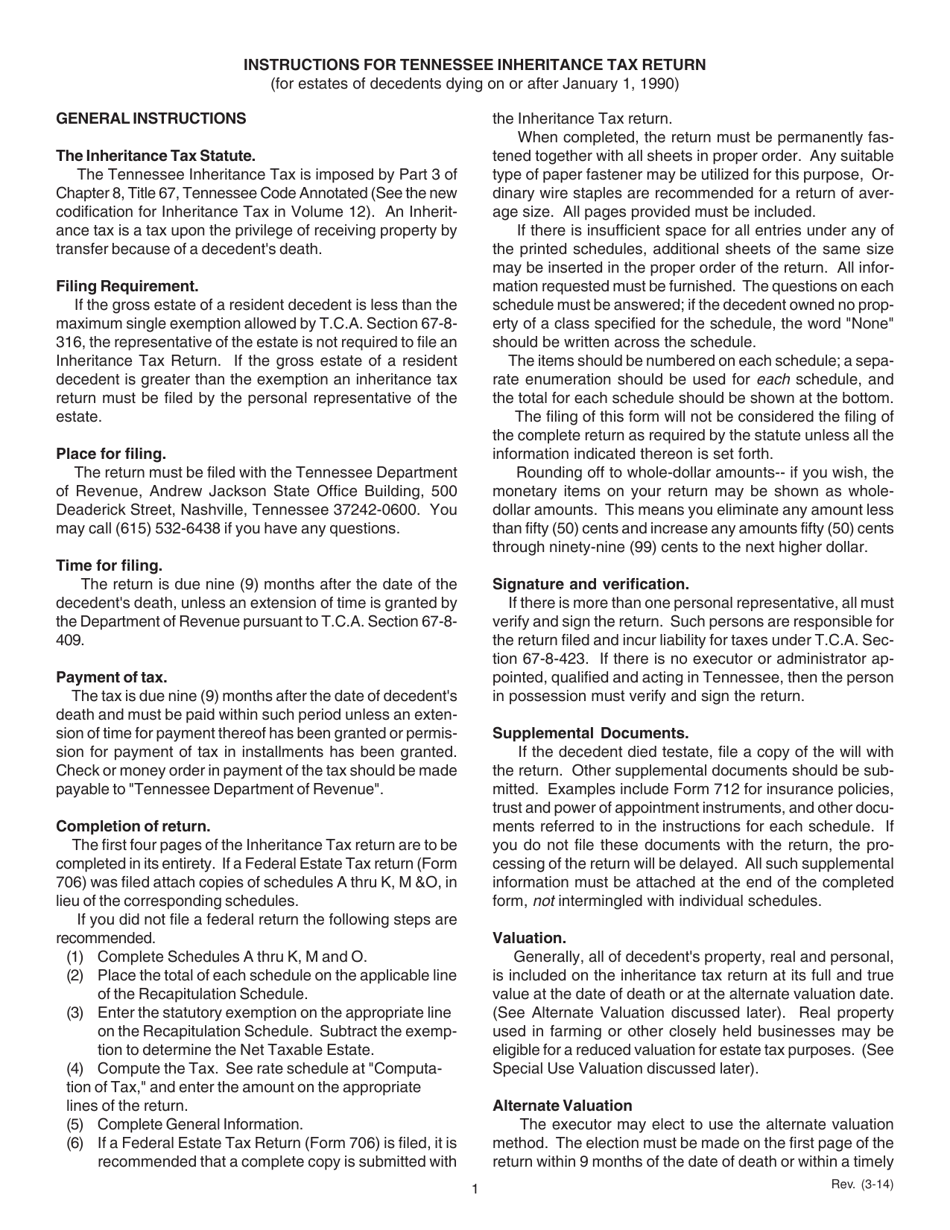

Also, estates of nonresidents holding property in tennessee must file an inheritance tax return (inh 301). The net estate is the fair market value of all assets, less any allowable deductions such as property passing to a surviving spouse, debts, and administrative expenses. The person who inherits the assets pays the inheritance tax, and tax rates vary by state.

That's because federal law doesn't charge any inheritance taxes on the heir directly. Tennessee does not have an inheritance tax either. No estate tax or inheritance tax.

They are imposed on the people who inherit from you, and the tax rate depends on your family relationship. If you owe inheritance taxes, the time frame to pay them differs from each state. Inheritance tax is a tax on the estate (the property, money and possessions) of someone who’s died.

Under tennessee law, the tax kicked in if your estate (all the property you own at your death) had a total value of more than $5 million. Generally, states that tax inheritances exempt a certain amount per. Ad questions answered every 9 seconds.

If you receive property in an inheritance, you won't owe any federal tax. Kentucky, for instance, has an inheritance tax that applies to all property in the state, even if the person inheriting it lives elsewhere. If the value of the gross estate is below the exemption allowed for the year of death, an inheritance tax return is not required.

You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000. A tax advisor will answer you now! The first rule is simple:

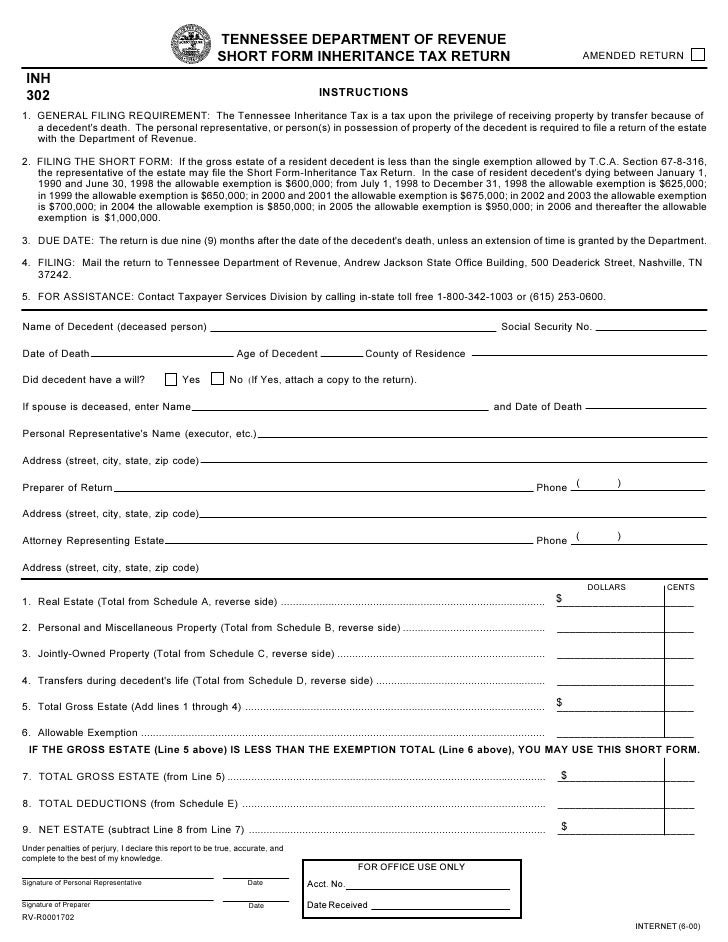

In 2012, the tennessee general assembly chose to phase out the state’s inheritance tax over a period of several years. However, if the estate is undergoing probate, a short form inheritance tax return (inh 302) is required.

How To Inherit Retirement Assets In Tennessee

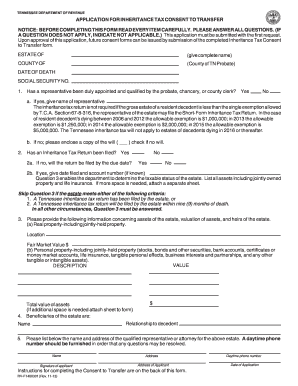

Tax Waiver - Fill Out And Sign Printable Pdf Template Signnow

2013-2021 Form Tn Rv-f1400301 Fill Online Printable Fillable Blank - Pdffiller

State Estate And Inheritance Taxes Itep

Tn Dor Inh 302 2015-2021 - Fill Out Tax Template Online Us Legal Forms

What You Need To Know About Tennessee Will Laws

Heres Which States Collect Zero Estate Or Inheritance Taxes

Wyoming Tax Benefits - Jackson Hole Real Estate - Ken Gangwer

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Inheritance Tax Return Short Form

States With An Inheritance Tax Recently Updated For 2020

Tennessee Taxes - Do Residents Pay Income Tax Hr Block

State Estate And Inheritance Taxes Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Download Instructions For Form Rv-r0001602 Inh301 Inheritance Tax Return Pdf Templateroller