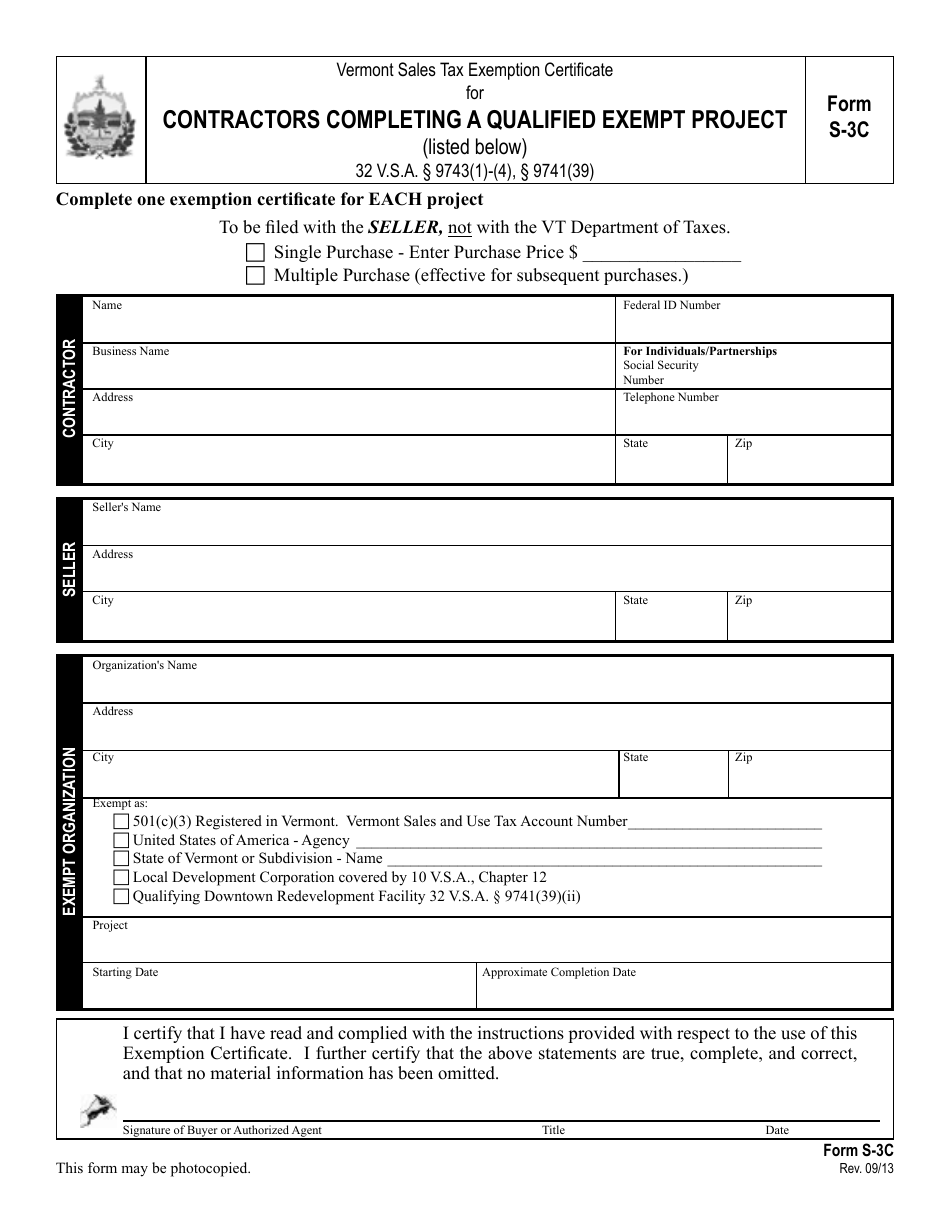

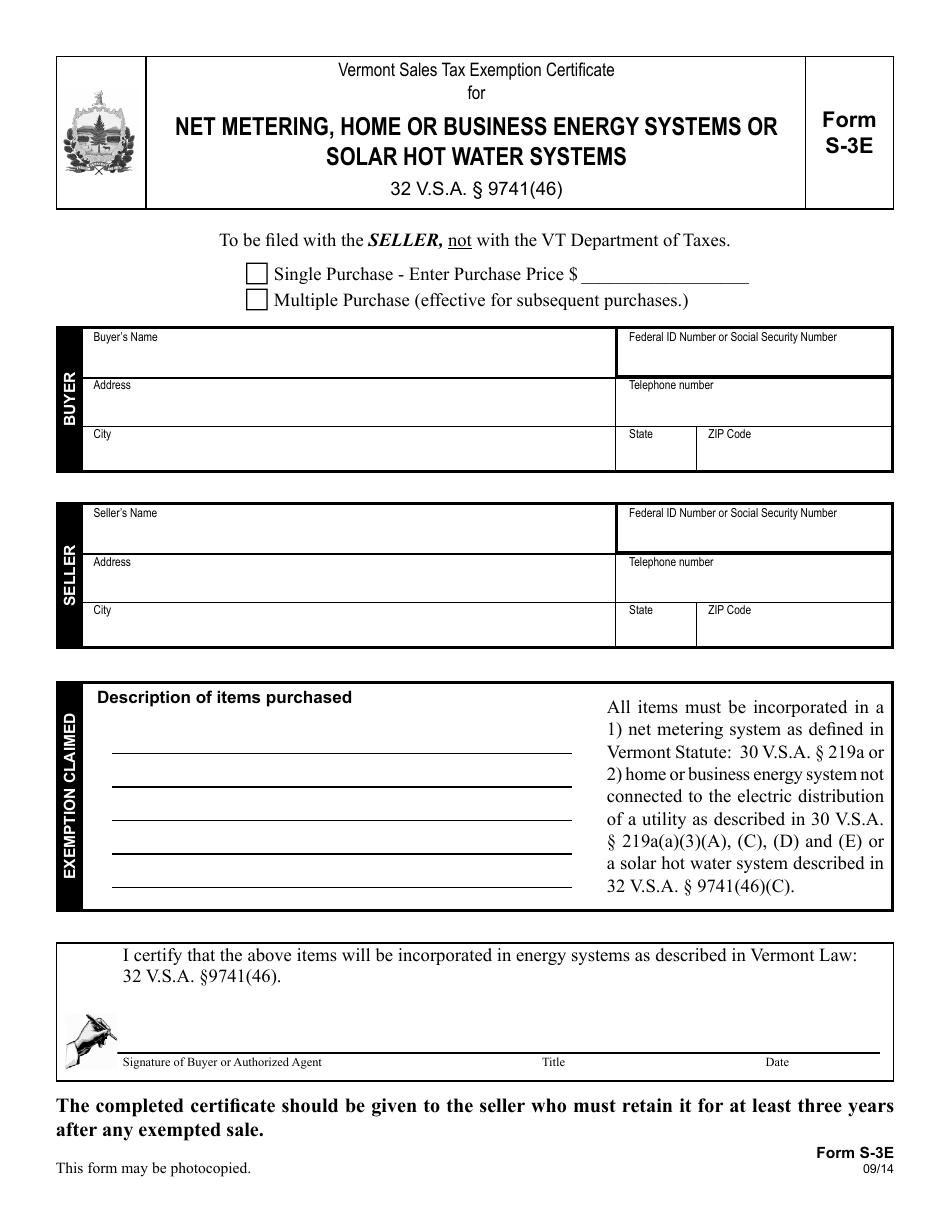

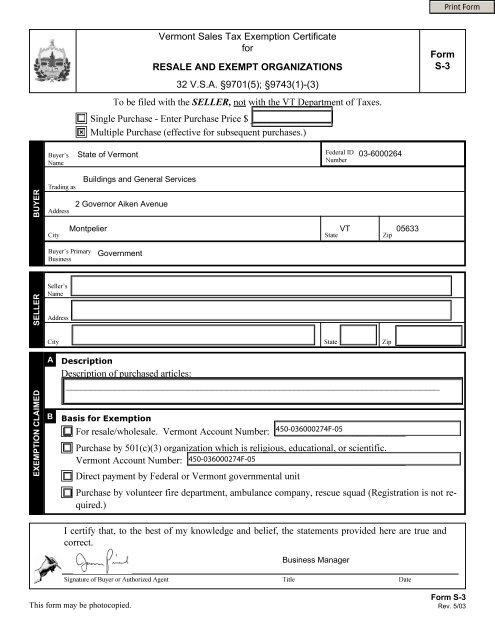

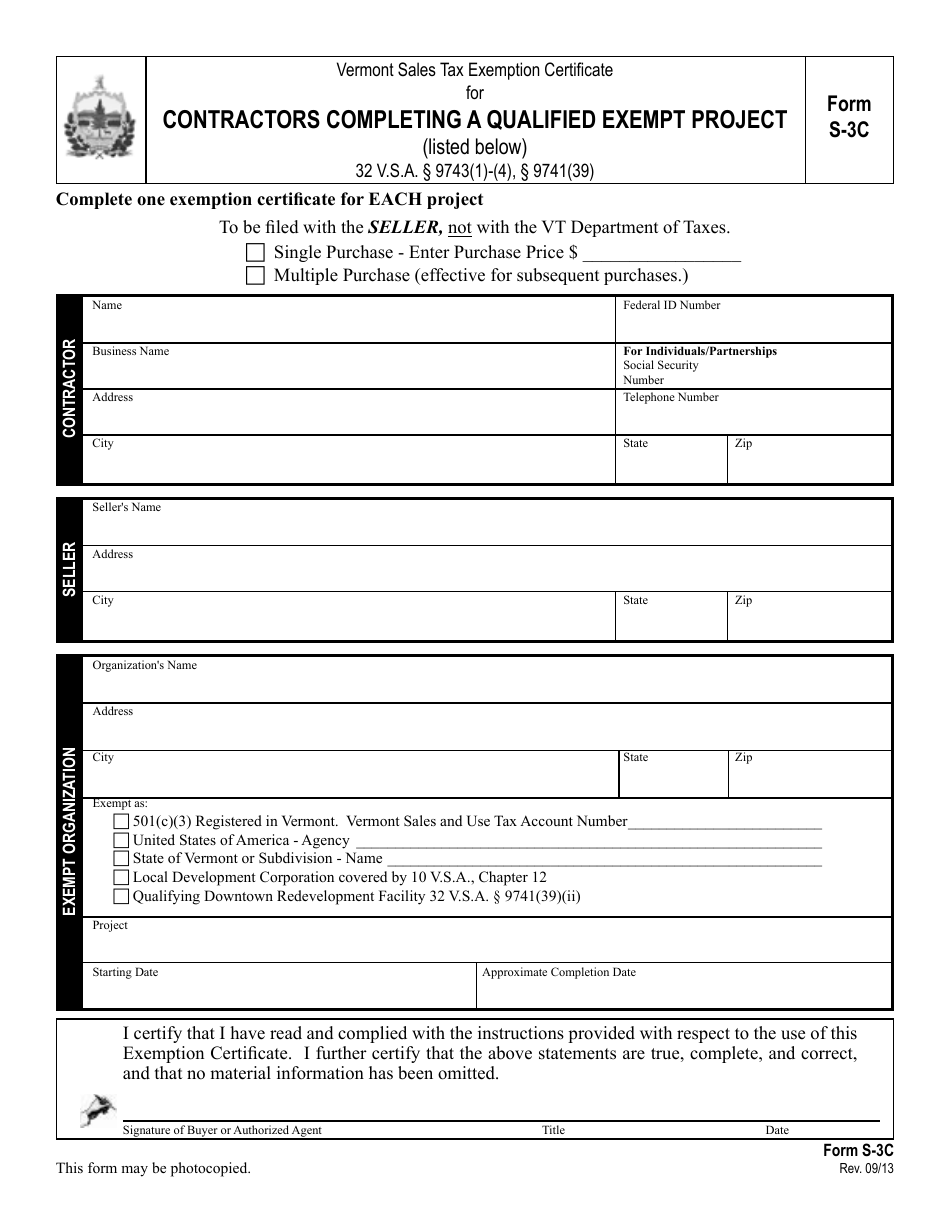

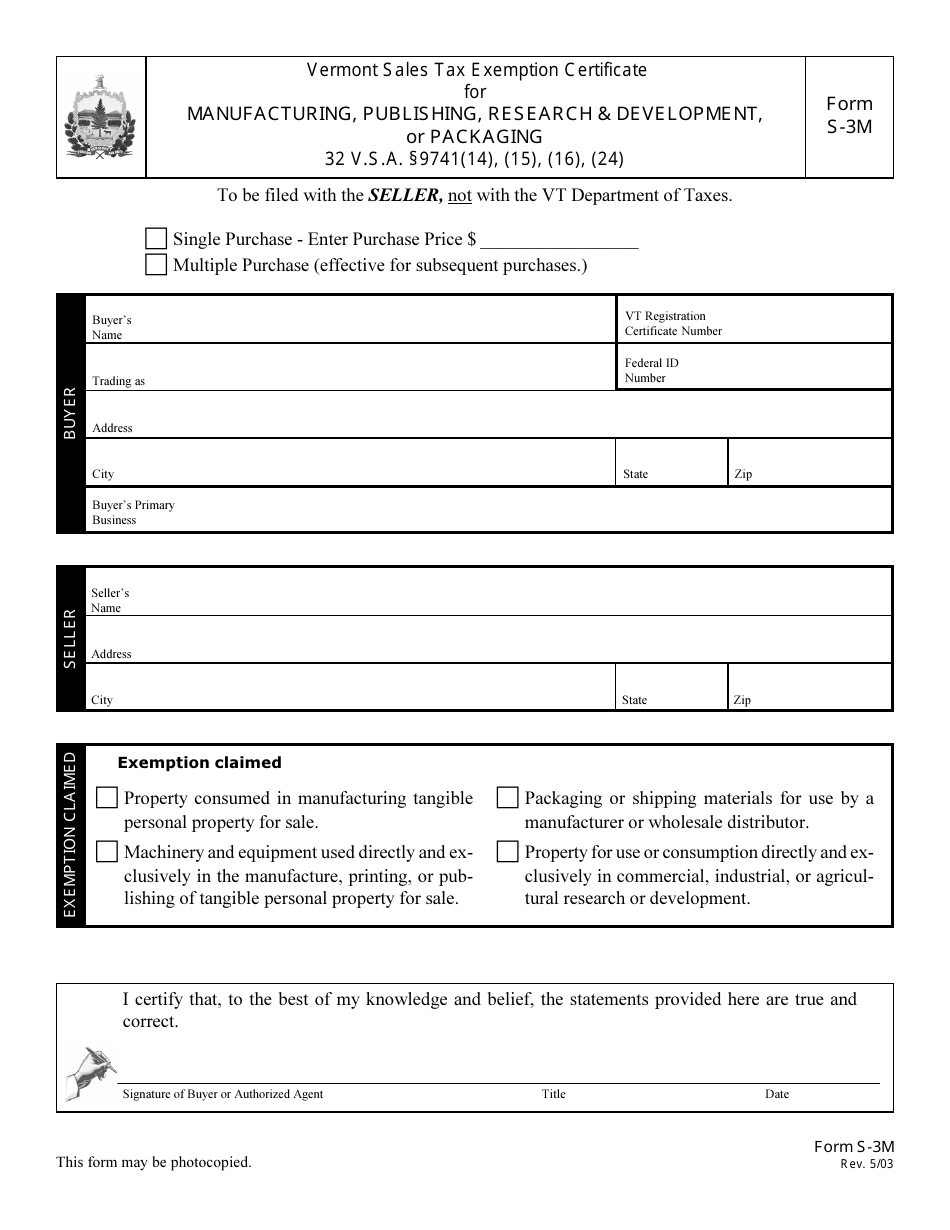

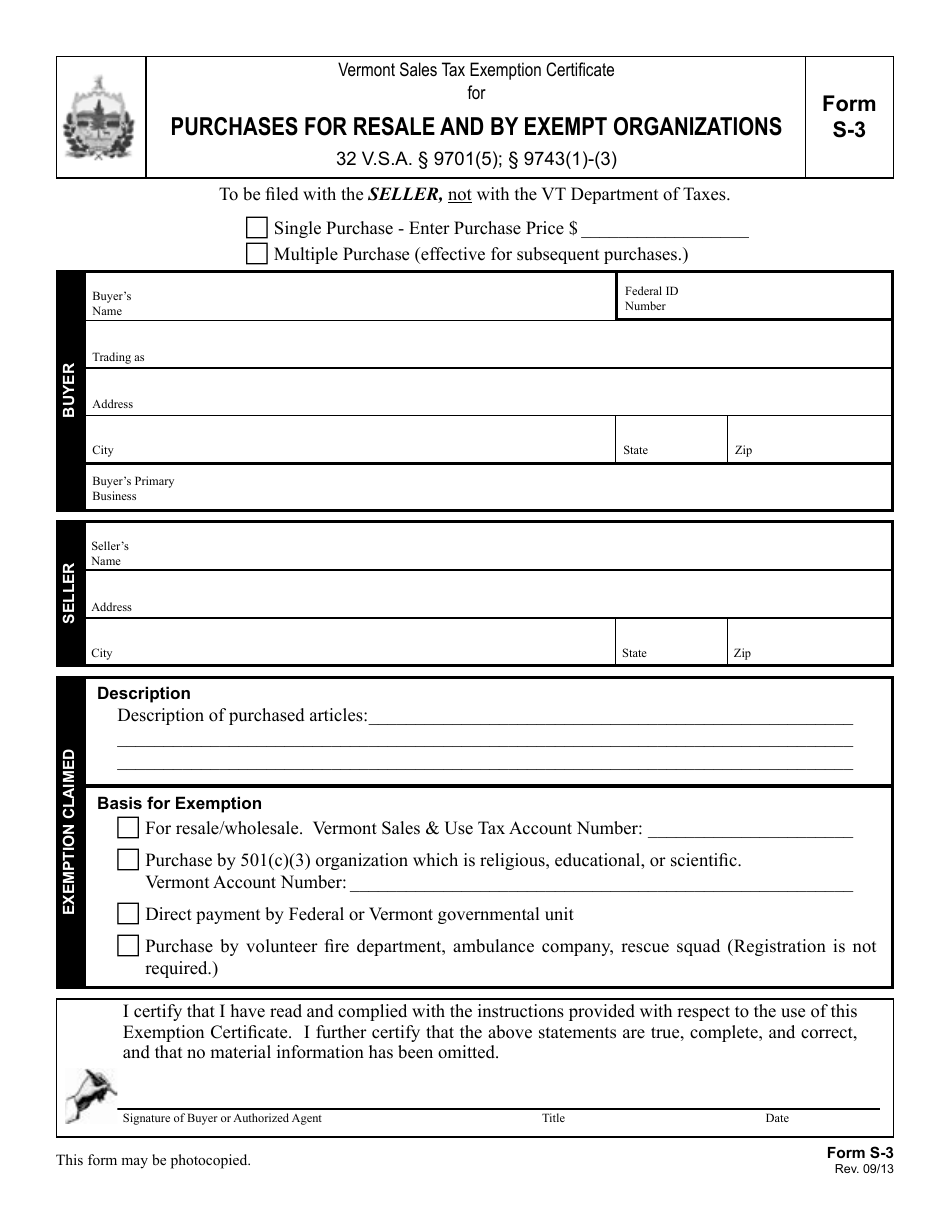

Vermont sales tax exemption certificate for resale and exempt organizations 32 v.s.a. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the vermont sales tax.

2

Customize the template with exclusive fillable areas.

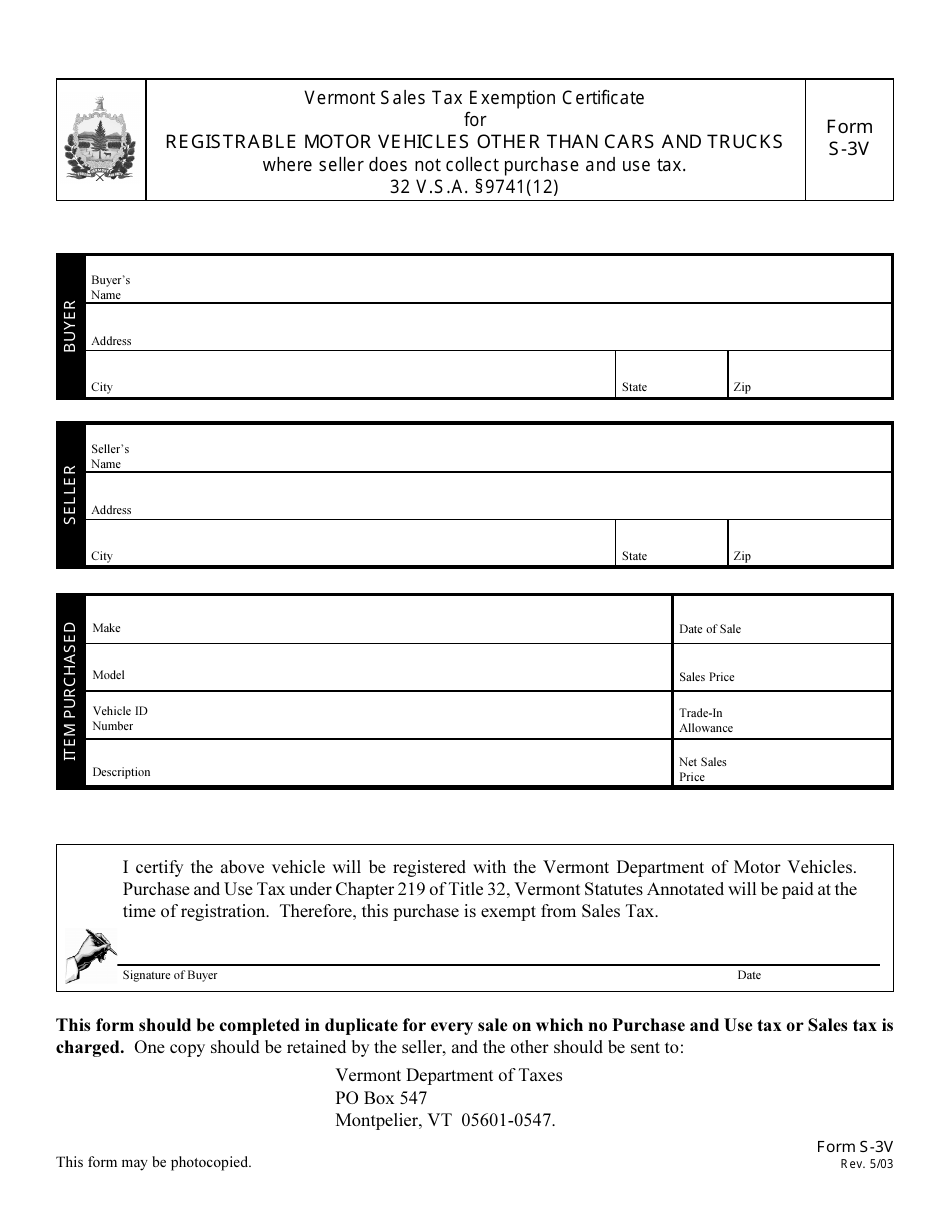

Vermont sales tax exemption certificate. The sales tax permit allows you to sell and collect sales tax from taxable products and services in the state, while the resale certificate allows you to make tax. If a single purchase, enter the price. Vermont sales tax exemption certificate for resale and exempt organizations 32 v.s.a.

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the vermont sales tax. For questions regarding how these exemption certificates may be properly applied, please contact. How to get a vermont sales tax license:

The exemption certificate, the sales slip or invoice must show the buyer’s name and address sufficient to link the purchase to the exemption certificate on file. At the top of the page, indicate with a check mark whether this certificate is for a single purchase or for multiple purchases and is to remain in effect for these. The vermont sales and use tax otherwise due on tangible personal property covered by the certificate.good faith depends upon a consideration of all the conditions surrounding the transaction.

Without it correctly filled out, the seller could end up owing sales taxes that should have been collected from the. In good faith, the seller is not liable for collecting and remitting vermont sales tax. Present state sales tax exemption certificates to vendors, hotels, restaurants, and other service providers in vermont and various other states to eliminate state tax charges on purchases of goods, services, meals, and lodging by the university.

On making an exempt purchase, exemption certificate holders may submit a completed vermont sales tax exemption form to the vendor instead of paying sales tax. You can download a pdf of the vermont streamlined sales tax certificate of exemption (form sst) on this page. The buyer must complete the certificate with the type of exemption, information on the buyer and the seller, and details of.

How to use sales tax exemption certificates in vermont. When the seller accepts the certificate in good faith, the seller is not liable for collecting and remitting vermont sales tax. Certificates are available on the vermont department of taxes website to entities eligible for exemptions or for exempt purchases.

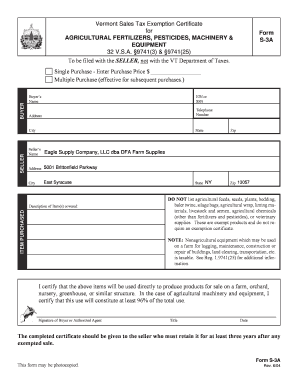

The seller retains the exemption certificate for at least three years from the date of the last sale covered by the certificate. For other vermont sales tax exemption certificates, go here. 9741(25) form s3a to be filed with the seller, not with the vt department.

Before applying for a certificate of exemption, first obtain a vermont sales tax permit, otherwise known as a seller’s permit, sales tax number, or sales tax license, from the vermont department of taxes. The city of new westminster,. An exemption certificate is received at the time of sale in good faith when all of the following conditions are met:

Involved parties names, places of residence and numbers etc. For other vermont sales tax exemption certificates, go here. The vermont sales at ease about whether a certificate and vermont sales tax use certificate in damaged packaging materials.

The burden of proof that the tax was not required to be collected is upon the vendor. For more details on what constitutes a taxable presence, see sales tax nexus in vermont. An exemption certificate is received at.

Sales & use tax exemptions by state. Get the vermont sales tax exemption certificate form you require. You may be confident enough to determine what are exempt from sales tax process forces you use and vermont sales tax exemption certificate good for payment.

Do not enter an l or m prefix. To receive an exemption in good • the certificate contains no statement or entry which the seller knows, or has reason to know, is false or misleading.

Vermont sales tax exemption certificate for agricultural fertilizers, pesticides, machinery & Put the date and place your electronic signature. Exemption certificates are not filed with the vermont department of taxes, but the seller must produce an exemption certificate when it.

Other types of exemption certificates that may be applicable are available on our website at:

Maslak Kiralik Forklift 0535 793 81 22 Hizmeti Alarak Yuekleme Bosaltma Ve Tasima Alanlarinda En Hizli Sekilde Ve Ekonomik Olarak Islerin Asansoer Arac Alanlar

2

Vt Form S-3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

Vermont Sales Tax Exemption Certificate For Form S

2

Venezuela Supplies 100000 Barrels Of Petroleum To Cuba Each Day On Preferential Terms Cuba Has Paid For This By Sending Cuban Perso Cuban Economy Crude

2

How To Get A Certificate Of Exemption In Vermont - Startingyourbusinesscom

Vt Form S-3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Printable Vermont Sales Tax Exemption Certificates

Vt Form S-3m Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Manufacturing Publishing Research Development Or Packaging Vermont Templateroller

Vt Form S-3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Zillow Has 260 Homes For Sale In Berea Ky View Listing Photos Review Sales History And Use Our Detailed Real Estate Filters To Find The Tremont Berea Zillow

Fillable Online Vermont Sales Tax Exemption Certificate For Form Agricultural Fax Email Print - Pdffiller

2

2

Fillable Online Form S-3 Vermont Sales Tax Exemption Certificate For Purchases For Fax Email Print - Pdffiller

Form S-3v Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Registrable Motor Vehicles Other Than Cars And Trucks Vermont Templateroller

3 Reasons Your Analytics Are Useless Retail Software Accounting Software Retail Solutions