The county’s exemptions are as follows: Hedding st, east wing, 5th floor.

Property Taxes - Department Of Tax And Collections - County Of Santa Clara

This translates to annual property tax savings of approximately $70.

Santa clara property tax exemption. Currently, 24 out of 32 of santa clara county’s school districts offer parcel tax exemptions, however, each school district has a different set of requirements for applying for those exemptions. You can pay tax bills for your secured property (homes, buildings, lands) as well as unsecured property (businesses, boats, airplanes). You could be exempt from the tax if you meet all of the following criteria:

Property tax rates for santa clara county. Santa clara valley water district senior exemption program 5750 almaden expressway san josé, ca 95118. Any tax imposed pursuant to sccc 3.35.020 shall be paid by any person who makes, signs or issues any document or instrument subject to the tax, or for whose use or benefit the same is made, signed or issued.

Your total household income for 2020 was below $60,330. Claims of exemption from the city conveyance tax or. Santa clara valley water district senior exemption program 5750 almaden expressway san josé, ca 95118.

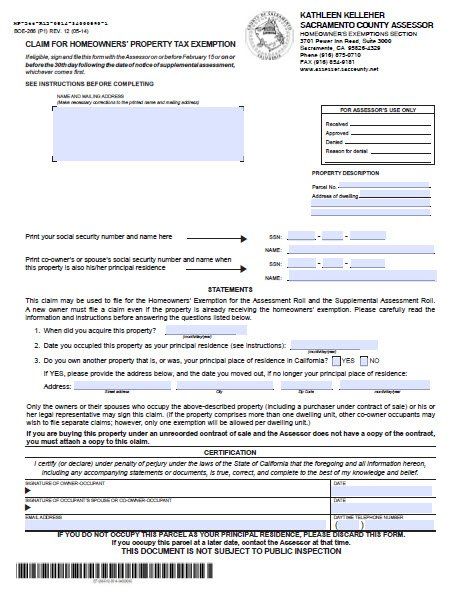

It limits the property tax rate to 1% of assessed value (ad valorem property tax), plus the rate necessary to fund local voter‐approved debt. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. Getting a homestead exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid santa clara county property taxes or other types of other debt.

On june 16, 2017 the santa clara county civil grand jury released a detailed report on parcel tax exemptions for seniors and homeowners with disabilities. To pay property taxes for secured property, you will need your assessor's parcel number (apn) or property address. Local school districts pass parcel taxes to supplement state funding for school supplies, classroom upgrades, and operating expenses.

California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000 of assessed value, may be granted. Mail or drop off address: You live in and own the home the tax is assessed on.

The report found that many school districts make it more difficult and complex to get information on the. Total household income is the total gross income for every person over 18 years old who lives in the home. 28 rows parcel tax exemptions.

Disabled veterans' exemption change of eligibility report. Examples of a pi include the exclusive right to use public property at an airport such as a car rental. If you have any questions regarding this program, please email seniorexemption@valleywater.org or call the valley.

The tax rate itself is limited to 1% of the total assessed property value, in addition to any debts incurred by bonds approved by voters. Following is information gathered from the county and state on possessory interest taxes. Properties located within san jose, palo alto and mountain view are taxable at a rate of $1.65 per $500 or fractional portion of real property value.

Proposition 13, the property tax limitation initiative, was approved by california voters in 1978. Documentary transfer tax as well as the applicable city conveyance taxes are collected at the time of recording. School districts may offer special assessment (sa) tax exemptions.

The exemption is available to an eligible owner of a dwelling which is occupied as the owner’s principal place of residence as of 12:01 a.m., january 1 each year; View and pay for your property tax bills/statements in santa clara county online using this service. The santa clara county assessor's office defines possessory interest this way:

If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the dwelling's assessed value, resulting in a property tax savings of approximately $70 to $80 annually. A person filing for the first time on a property may file anytime after the property or claimant becomes eligible, but no later than february 15 to receive the full exemption for that year. These taxes are available to cities, counties and school districts.

You were born before june 30, 1957. Mail or drop off address: Property owners who occupy their homes as their principal place of residence on the lien date (january 1st), and each year thereafter, are eligible for the exemption if they file a claim.

Parcel taxes are real property taxes that are based on the assessed value of a homeowner’s property. If you have any questions regarding this program, please email [email protected] or call the valley water tax hotline at. Possessory interest (pi) the possession or the right to possession of real estate whose fee title is held by a tax exempt public agency.

New applicants must mail or deliver a signed application to valley water headquarters by june 30 to be exempt from the upcoming property tax year. New applicants must mail or deliver a signed application to valley water headquarters by june 30 to be exempt from the upcoming property tax year. Santa clara county offers property tax exemptions for selected homeowners that can help reduce the amount of property tax you have to pay in this california county.

Pin On Data Center Evolution

Cook County Property Tax Bills May Be Delayed By Inter-office Controversy - Abc7 Chicago

Secured Property Taxes Treasurer Tax Collector

Applying For The California Property Tax Welfare Exemption An Overview Nonprofit Law Blog

California Public Records Public Records California Public

Business Property Tax In California What You Need To Know

Gowork Leases 125 Lakh Sqft Office Space In Delhi Ncr Ncr Lease Office Space

Property Taxes - Department Of Tax And Collections - County Of Santa Clara

East Islip School District Calendar Elementary Schools Calendar Board School District

Secured Property Taxes Treasurer Tax Collector

Understanding Californias Property Taxes

Property Tax Email Notification - Department Of Tax And Collections - County Of Santa Clara

Meet The Millennial Google Employee Living In A Truck In The Parking Lot Say Google Google News Google

Prop 19 Ahead Would Change Residential Property Tax Transfer

Grand Jury Santa Clara County Schools Impede Tax Exemptions

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News

Property Tax Exemption For Live Aboards

What Is A Homestead Exemption California Property Taxes

Scam Alert - County Of Santa Clara California Facebook