Connecticut collects a 6% state sales tax rate on the purchase of all vehicles. Do you pay taxes on a leased car in ct?

Can I Move My Leased Car Out Of State - Movingcom

Some municipalities give the option of paying the bill in installments.

Do you pay taxes on a leased car in ct. Max_g may 23, 2019, 6:27pm #6. You can save in other ways, ie if a dealer in nj or ct is more competitive. Leased and privately owned cars are subject to property taxes in connecticut;

Alaska (juneau only) arkansas connecticut kentucky That means you owe taxes on only $10,000, instead of $30,000. For most connecticut municipalities the tax due date for the october 1st grand list bill is july 1st.

The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle, i.e., the leasing agency or dealer. Property tax treatment varies from state to state as well. In most cases, the agreement made between the dealer or leasing agency and the person leasing the vehicle will pass the cost of property taxes on to the lessee, most frequently as part of the monthly payments.

Tax on motor vehicles leased in other jurisdictions and brought into connecticut: If you end your car lease early, you won't have to worry about cancelling road tax payments. Ask your honda dealer for information about the tax regulations in your state or contact the tax assessor office.

Since the leasing company owns the vehicle you are. In addition to taxes, car purchases in connecticut may be subject to other fees like registration, title, and plate fees. 2 and july 31 pay a prorated amount, depending on when the vehicle was registered.

Check with your state’s tax or revenue department. Do i pay taxes on my leased vehicle? Plus bmwfs and mbfs (and perhaps some others) will allow msd if you lease out of state.

Excise taxes in maine, massachusetts, and rhode island; Calculating lease car tax is essential when considering a car lease, as most advertised lease specials do not include tax in the lease payments. If you are a lessee and your vehicle is garaged in one of the following states, you may be responsible for paying state or local property taxes.

A bill of sale from the leasing company indicating the sales tax on the buyout option was collected. You can find these fees further down on the page. Remember that taxes vary in ny by county so check that yours is indeed 8.875%.

Luckily, this means you won’t need to tax your car for the duration of your lease contract. When you lease a vehicle, the car dealer maintains ownership. Most leasing companies, though, pass on the taxes to lessees.

Ct property tax on cars that are leased. If you lease a vehicle in connecticut, you aren’t paying sales tax on the value of the entire vehicle. Tax assessors bill the car dealer for vehicle taxes, but whether or not they pass that on to you will be delineated in your lease contract.

This makes sales tax on a lease car much less than on a car your purchase. You only pay sales tax on the monthly payments and on the down payment, which adds up to a fraction of the full vehicle value. For vehicles that are being rented or leased, see see taxation of leases and rentals.

Before contacting a dealership, you consider the true value of a car lease by adding sales tax to an advertised lease payment. They are not subject to local taxes in new jersey, new york, and vermont. You only pay sales tax on the monthly payments and on the down payment, which adds up to a fraction of the full vehicle value.

Not all leases allow for a lease buyout, so read the. If you do pay the personal property tax, you can deduct it on your taxes if you itemize. If you lease a vehicle in connecticut, you aren’t paying sales tax on the value of the entire vehicle.

The most common method is to tax monthly lease payments at the local sales tax rate. However, the bill is mailed directly to the leasing company since leased cars are registered in the company's name. When you lease a car, you pay for the vehicle’s depreciation during the course of the lease, plus interest.

The insurance card must be in the name of registered. The due date for the supplemental list bill is january 1st. Connecticut connecticut car owners, including leasing companies, are liable for local property taxes.

While leasing gives you the opportunity to drive a car with the latest comfort, safety, and infotainment technologies, it also comes with quite a few fees that you’ll want to know about. This means you only pay tax on the part of the car you lease, not the entire value of the car. This should equal the amount the lease company is charging you for.

For example, if your local sales tax rate is 5%, simply multiply your monthly lease payment by 5% and add it to the payment amount to get your total payment figure. A motor vehicle originally leased in another jurisdiction and subsequently brought by the lessee into connecticut for use in this state (such as when the lessee moves from another state into connecticut) is subject to connecticut tax only on the periodic payments and any other payments (such as. The tax due date is usually jan.

When you buy out your lease, you’ll pay the residual value of the car (its value at the end of the lease) plus any applicable taxes and fees. Provide your current connecticut insurance identification card, which can be obtained from your insurance company. And motor vehicle registration fees in new hampshire.

Owners of vehicles registered between oct. Vehicles registered between october 2nd and july 31st will be listed on a supplement to the october 1st grand list. On the other hand, if you bought a car, you would be responsible for taxing it annually.

Who is responsible for ct property tax on cars when you are leasing? Some build the taxes into monthly lease payments, as landlords build real estate taxes into monthly rent payments, while others pay the tax and then bill the lessee for the tax payment, explained colchester tax assessor john. Prgordo68 may 23, 2019, 6:37pm #7.

Review your contract, calculate the total miles that you put on the vehicle in excess of the lease contract, and multiply this by the cost per mile figure in your contract. Chances are you have already paid at least some sales tax on the car, so it's highly unlikely you need to pay taxes on the original price of the leased car. Most states roll the sales tax into the.

All tax rules apply to leased vehicles. A federal odometer statement properly completed by the leasing company. If you lease a $30,000 car with a residual value of $20,000, for example, you will pay $10,000 in monthly payments over your lease period.

0jenkpaojrhcvm

Hyundai Kona Suv Offers Lease Prices - Watertown Ct

Lincoln Lease In Woodbridge Ct Crest Lincoln Of Woodbridge Crest Lincoln Of Woodbridge

Local Taxes On Leased Cars

Bmw 3 Series Lease Deals Offers - Bridgeport Ct

Hyundai Tucson Suv Offers Lease Prices - Watertown Ct

Land Rover Lease Deals And Finance Specials In Fairfield Ct Land Rover Fairfield

Gls450 Lease Nyc 0 Down In Ny Nj Ct Near Brooklyn Vip

The Benefits Of Buying Off-lease Cars - Carfax

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Pilot Lease Nyc 0 Down In Ny Nj Ct Near Brooklyn Vip

What Are The Tax Benefits Of Leasing A Car For Business - Debtcom

Bmw X5 Lease Deals Offers - Bridgeport Ct

Buy Or Lease A Subaru - Mitchell Subaru Near Hartford Connecticut

Image Result For Leasing Finance Finance Financial Services Interventional Radiology

Tax Implications Of Business Car Leasing Company Car Lease Tax

Free Connecticut Lease Agreement Forms Ct Rental Templates

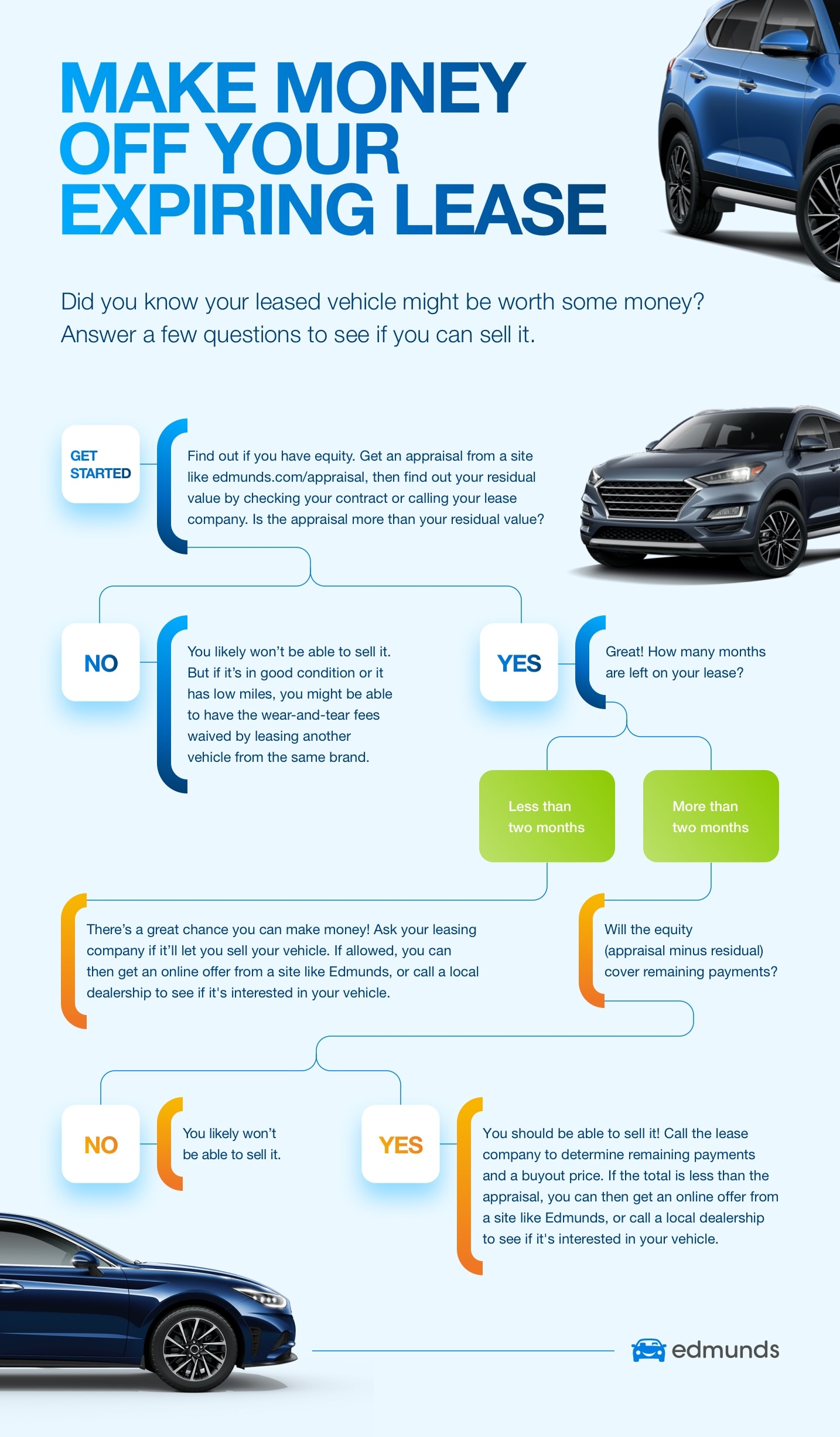

Consider Selling Your Car Before Your Lease Ends Edmunds

Pdf Capital Market Imperfection And The Incentive To Lease