Change the number in the display records entry to 3000 and click search again. Bills must be paid by money order, cashier's check, or certified check.

251 E Maxwell St Lexington Ky 40508 Realtorcom

(lex 18) — many people may never want to think about 2020 again, but with tax season approaching, we'll have to wait a little longer to say goodbye to the year completely.

Lexington ky property tax bill 2020. Various sections will be devoted to major topics such as: Of a tax bill lien is $46.00, per lien, for a five (5) page document. Property tax due dates are set by statute and the office of sheriff has no authority to negotiate deadlines or offer extensions.

If the legislature approved such a tax, a 1 percent tax on restaurant bills would generate $9.1 million in additional revenue for the city. Online payment of your county tax bill(s) can only be paid through our sheriff’s website at www.fcsoky.org when paying online use required information from your 2021 tax bill(s). County clerk contact information address:

The median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. Taxing d istrict option 1 option 2 option 3 general $148.00 $144.30 $149.85 total $148.00 $144.30 $149.85 The median property tax in fayette county, kentucky is $1,416 per year for a home worth the median value of $159,200.

Property tax payments made between receipt of bill and november 30 will receive a 2% discount. Another option is a restaurant tax. The net increase to fund balance is $120,080.

Please call or visit our website bill search inquiry screen to obtain the amount due. Releases or assignments that list more than one tax bill number will be returned for correction. Login to the tax master service above.

Fayette county collects, on average, 0.89% of a property's assessed fair market value as property tax. They determine the amount owed on all real estate within scott county. All delinquent tax payments should be submitted by mail or drop box.

The assessment of property, setting property tax rates and the billing and collection process. Bills not paid by april 15, 2019 become delinquent with a penalty of 21% and are transferred to the fayette county clerk for collection. Tax amount varies by county.

You can lookup your county tax bill at clark county sheriff’s department. Each additional page is an additional $3.00 per page. Enter the tax year you wish to search or select [all].

The name and address on your property tax bill is provided to the sheriff by the property valuation administrator. Increase rates to those that give a 4% revenue increase from existing real properties per house bill 44 limits. General fund property tax bill.

Allow up to 15 business days from the payment date to ensure bank verifications of sufficient funds for check payments. Counties in kentucky collect an average of 0.72% of a property's assesed fair market value as property tax per year. The bill number is used to track the actual tax bill and its payment status.

The city of winchester does not sell delinquent. Any checks returned to the county will result in a reversal of the tax payment. The tax bill you receive from the sheriff’s office is the amount assessed by the scott county property valuation administration.

Property taxes (no mortgage) $43,540,100: The reader should not rely on the data provided herein for any reason. Search property taxes using our online tax master service.

Larger cities in kentucky can not levy a restaurant tax but some cities, such as elizabethtown, can. This website is a public resource of general information. (no username or password) instructions for generating a list of delinquent taxes:

Main street room 132 lexington, ky 40507 The fayette county property valuation administrator is responsible for determining the taxable value of your property and any exemptions to which you may be entitled. In an effort to assist property owners understand the administration of the property tax in kentucky, this website will provide you with information that explains the various components of the property tax system.

That’s if lexington was able to keep 100 percent of that tax. The tms number is the number used to track the market value, assessment, and ownership information on the property. A total of 119,226 property tax bills with a face value of $389,490,441 are being printed and mailed.

Fayette county property tax collections (total) fayette county kentucky; Three items at the top of a real estate tax bill that identify the property are: My office is responsible for collecting taxes for 28 districts throughout scott county.

A new online property tax payment option will be available for paying 2021 county property tax bills. Note that if a property has recently been sold, there may have been insufficient time to update the owner’s name and address prior to the tax bill. Legal description, property location, and tms number.

If you live in the city or your business is located in the city, you will receive a city tax bill and a county tax bill. The county clerk's office is responsible for collecting delinquent property tax bills. You can pay your county tax bill at the sheriff’s office which is located at 17 cleveland avenue in winchester.

Kentucky is ranked 880th of the 3143 counties in the united states, in order of the median amount of property taxes collected. Tax bills are normally mailed out on november 1st each year and your tax bill will include the following important information: Lexington county makes no warranty, representation or guaranty as to the content, sequence, accuracy, timeliness or completeness of any of the database information provided herein.

Tax Bill Payments

150 Westgate Dr Lexington Ky 40504 Realtorcom

Pin On Books Smaller Than Quartos

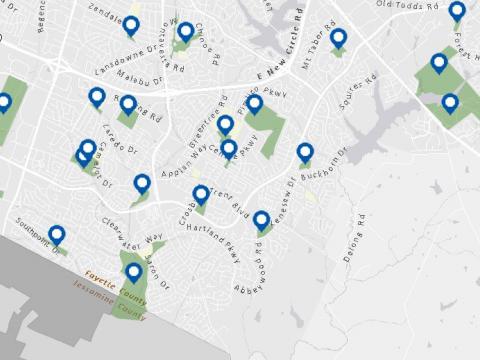

With Price Reduced - Homes For Sale In Lexington Ky Realtorcom

3069 Caddis Ln Lexington Ky 40511 - Realtorcom

Fayette County Clerks Office Remains Closed To The Public City Of Lexington

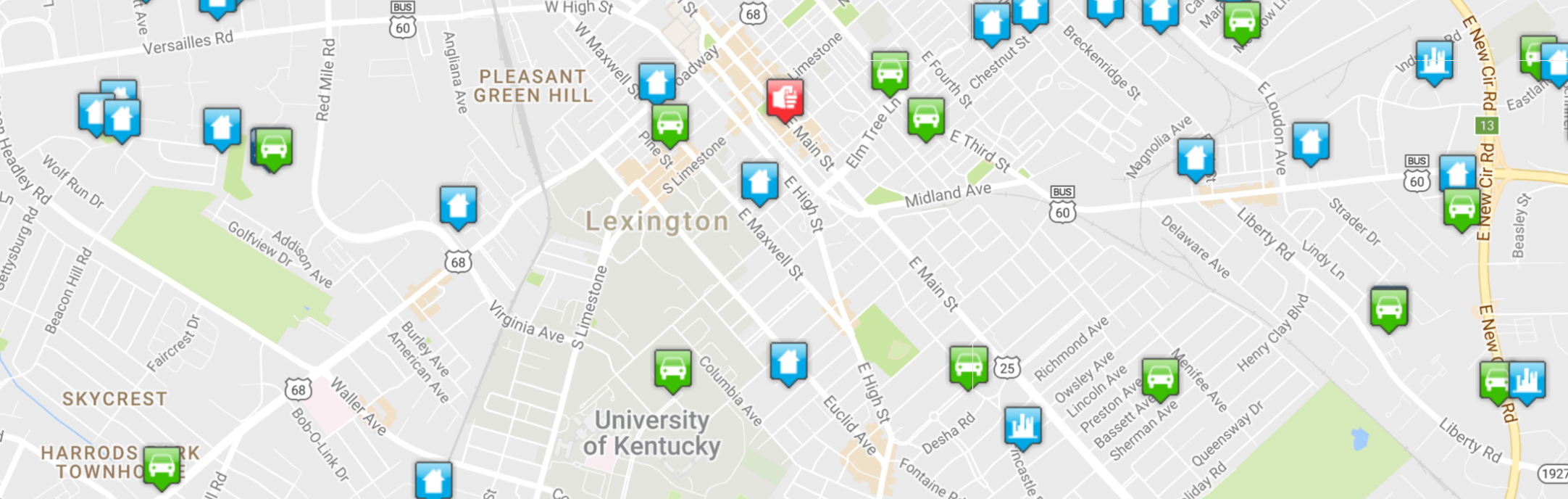

Community Crime Map City Of Lexington

Thats Enough 2020 Roofer Roofing Emergency Roof Repair

160 Winston Ave Lexington Ky 40505 - Realtorcom

2

2020 Willis Dr Lexington Ky 40511 - Realtorcom

2

2

Geographic Information Services City Of Lexington

1969 Covington Dr Lexington Ky 40509 - Realtorcom

1101 Chinoe Rd Lexington Ky 40502 - Realtorcom

2000 St Stephens Grn Lexington Ky 40503 - Realtorcom

Chapter 7 Vs Chapter 13 Bankruptcy Whats Best For You Daily Infographic Chapter 13 Bankruptcy Home Equity Line

2